Meanwhile, with the Barclays U.S. Aggregate Bond Index duration near multi-decade highs, while yields are in the lower end of the multi-decade range, income investors have had to absorb more risk to maintain yield—a common theme in the markets these days.

CHART 3: While yields have declined, duration has left investors more exposed to interest rate risk. Source: Bloomberg

So how can investors approach their income portfolios going forward? Diversifying rate-sensitivity risks, to our way of thinking, appears to be a reasonable place to start. Even if you subscribe to the theory that this move is overdone, there is still the likelihood, in our view, of having to contend with a good deal of interest rate volatility. This means adding strategies to complement traditional passive holdings can help to balance out a portfolio. The issue, though, is knowing when to make these changes.

At Astor, we take a macro approach to active asset allocation, including in fixed income investing. This approach allows us to see risks developing from the top down and adjust exposure to broader risk variables. Our Active Income Strategy addresses this head on, specifically as we seek to assess risk and identify opportunities across the capital market spectrum, by diversifying both credit quality and duration/interest rate exposure.

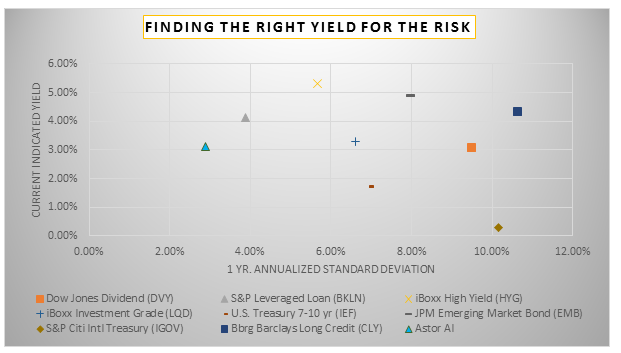

An active approach allows us to select from assets with differing risk and yield profiles. By selecting from non-correlating, income-generating assets, we believe the portfolio can provide a better risk-to-yield profile and complement traditional income based strategies to help achieve better long-term result.

CHART 4: Market yields with their risk profile (corresponding ETF tickers DVY, LQD, IGOV, BKLN, IEF, CLY, HYG, EMB). Source: Bloomberg, Astor

In summary, an active income strategy with the ability to adjust duration, credit quality, and allocate to other asset classes, in our view, can provide both diversification and risk management. The combination of assets with varying correlation, risk and yield profiles can further diversify the portfolio, manage risk, and reduce the impact of one variable—interest rates—on a portfolio. Given the prevailing economic trends and market conditions, we believe this approach is vitally important today.

For more on Astor’s Active Income Solution, please click here.

Bryan Novak is the Senior Managing Director & Portfolio Manager at Astor Investment Management, a participant in the ETF Strategist Channel.

Disclosure Information

At the time of writing, Astor Investment Management held GSY, BKLN, SRLN, AGG and LQD.among its universe of ETFs included in its multi-asset portfolios. Astor Investment Management is a fundamentally driven quantitative asset manager that seeks to empower clients with economics-based tools and portfolio solutions to reduce risk and help attain investment goals. Contact Astor at 1-800-899-3230 or [email protected]. For a complete list of relevant disclosures, please click here. 312161-569.