Commodity ETFs have enjoyed greater investment interest this year as a recovery in oil prices and resurgence in safe-haven gold bets helped attract steady inflows.

However, that scenario could be challenged if the recent rally in the U.S. dollar continues.

Still, investors should main some exposure to alternative asset classes, such as commodities. A diversified approach is suitable for some that do not want to attempt to time upside in popular commodities such as gold, oil and silver.

SEE MORE: A Bright Precious Metals ETF Outlook

The PowerShares DB Commodity Index Tracking Fund (NYSEArca: DBC), which offers exposure to multiple commodities, has been a solid performer this year, too. Another name in the diversified commodities ETF group to consider is the iShares S&P GSCI Commodity-Indexed Trust (NYSEArca: GSG).

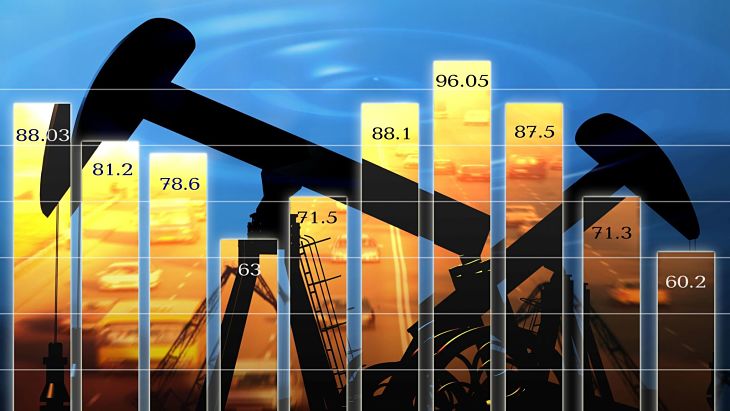

On the supply side, U.S. crude oil production is faltering, which has helped support crude prices. Moreover, the depreciating U.S. dollar has helped support demand for commodities as an alternative hard asset or a better store of wealth.

Commodities were the best performing asset class of the first half of the year, outperforming global bonds and equities. The Bloomberg Commodity Index was up over 14% over the first six months of 2016.