Source: Zephyr StyleADVISOR

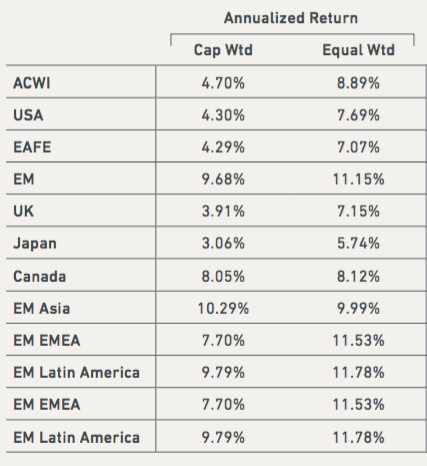

Also, what about an equal-weight approach in other settings other than the S&P 500? Although these indexes take an equal-weight approach with individual stocks and not sectors, the concept of avoiding the flaws of a cap-weighted approach still apply and the benefits are consistently and readily seen across many assets:

Source: MSCI; performance summary for selected MSCI indexes. Net Index Monthly Returns, January 29, 1999 to July 31, 2015. Past performance is not indicative of future results.

From December 2000 to July 2015, equal-weighted versions of MSCI flagship indexes delivered significantly higher returns than their cap-weighted counterparts, outperforming 11 out of 12 indexes. Equal weighting benefits investors who wish to reduce concentration of mega or large-cap stocks in their portfolio, obtain more exposure to smaller-cap and value stocks, take advantage of potential market price inefficiencies, and adopt a disciplined rebalancing process. In contrast, a market-capitalization approach is 100% dependent upon the whims of the market and no built in “sell high/buy low” discipline is in place. These advantages occur whether equal weighting sectors or stocks.

Another study using the long-term global equity market data built by Dimson, Marsh, and Staunton (this data set is available through Morningstar), makes a strong case for an equal-weight approach. Even though the study is referring to global portfolios, as seen above the concept of equal weighting applies just as well across multiple countries. In this global equity study, an equal-weighted portfolio of 20 major countries from 1900-2012 was compared to its cap-weighted counterpart. The difference is graphed out in the mountain chart below, as it tracks the long-term growth of $1 in the world equity portfolio (weighted by market cap) and an equal-weighted version of the world portfolio.

An astonishing difference to say the least, with the equal-weighted approach outperforming its market-cap counterpart by over 6 times!

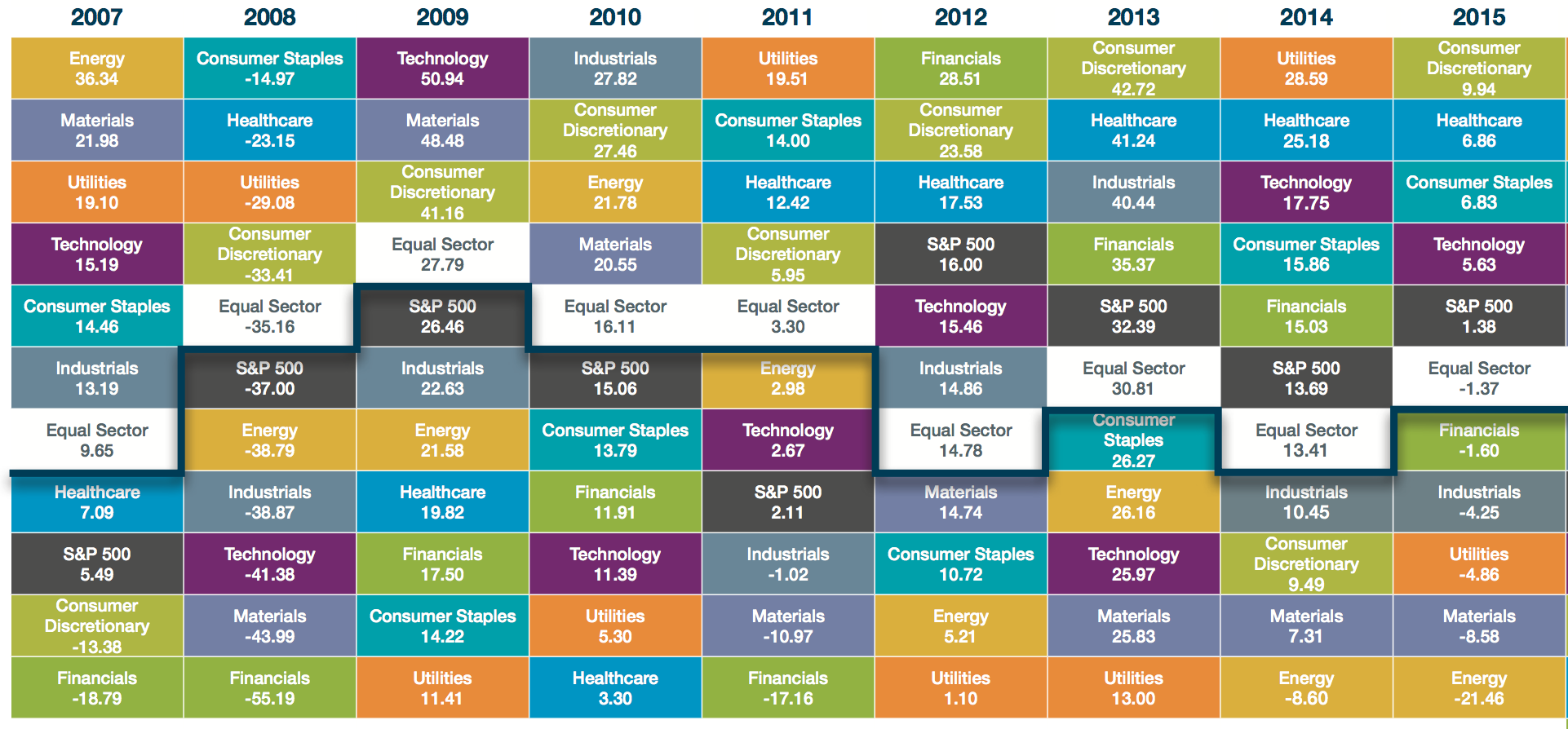

One study on the returns of the equal-weight and cap-weight versions of the S&P 500 back to 1926 estimates that the equal-weight version returns outperforms the cap weighted version by 2.8% per year (Source: Mutual Fund Observer, September 2016 issue). S&P’s researchers have the advantage at around 180 basis points per year from one of their studies. These numbers are fairly close to the per year outperformance that has been seen since late 1998 when the SPDR Select Sector ETFs launched. (Source: Zephyr StyleADVISOR)

Source: Alps and Bloomberg

In summary, equal-weighting of the sectors provides for better diversification, lower volatility, and the potential for better long-term performance as compared to cap-weighted. These benefits are mostly driven by the periods of outperformance generated through and after bear markets as overvalued and overweighted sectors correct. Although no one can predict the market, long-term and short-term evidence points to an equal-weighted approach being a more prudent and potentially beneficial choice over cap-weighted. This is why at Swan we allocate our core equity component in our S&P 500 Defined Risk Strategy using the SPDR Select Sector ETFs in an equal sector weighting. We believe this core equity position coupled with a long-term hedge and our option income component, are the best way to achieve consistent long-term risk-adjusted returns in today’s risky market environment.

Micah Wakefield is Director of Research and Product Development at Swan Global Investments, a participant in the ETF Strategist Channel.