The September Jobs Report also brought additional encouraging data points. One positive was that the Civilian Labor Force expanded by 444,000 people. Labor force expansion usually occurs when people feel more confident about finding a job and thus begin to actively seek to do so. Consequently, the bump in the unemployment rate from 4.9% to 5.0% was actually a result of greater job market participation. Also notable was that wages in September were up 2.6% year over year, a particularly bright spot that bodes well for the Fed’s inflation target of 2%.

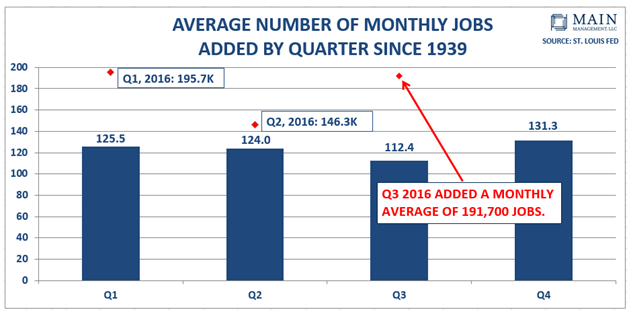

While the September jobs number itself wasn’t particularly strong at 156,000 jobs, if you include the total number of jobs added in July and August and take a monthly average, the third quarter (Q3) on average added 191,700 jobs per month. The chart below shows this is well above the average number of monthly jobs added for the third quarter (Q3) which averages 112,400 monthly jobs dating back to 1939. Moreover, this closely mirrors the robust 195,700 average from the first quarter of 2016.

There are a number of positive data points that might ordinarily prompt the Fed to act on raising interest rates. Perhaps the prevalence of negative sovereign interest rates to combat a weaker global economy weighs on their collective minds. The fear that higher interest rates will strengthen the dollar, which may put more pressure on corporate margins and thereby negatively impact the outlook for exports, may also have created some trepidation. That said, the greenback is still lower than it was at the start of 2016. However, domestic economic indicators continue to provide ample ammunition for the Fed to pull the trigger, an event we anticipate finally occurring in December.

Hafeez Esmail is the Chief Compliance Officer at Main Management, a participant in the ETF Strategist Channel.

A pioneer in managing all-ETF portfolios, Main Management LLC is committed to delivering liquid, transparent and cost-effective investment solutions. By combining asset allocation insights with smart implementation vehicles, Main Management offers a unique approach that translates into distinct advantages for our clients, including diversification, cost efficiency, tax awareness and transparency. http://www.mainmgt.com