Looking ahead, the ongoing negative interest rate environment, with European and Japanese central banks cutting benchmark rates deeper into the red to promote growth, could push investors toward precious metals as a more stable store of wealth.

SEE MORE: Silver ETFs Are Outshining Gold

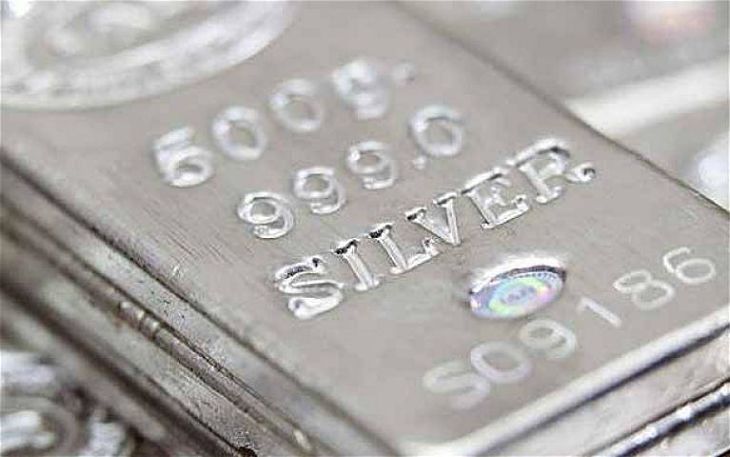

Moreover, unlike gold, silver sees much higher industrial demand. The precious metal enjoys heavy industrial demand that benefits from an expanding global economy.

“To be conservative, we also assume that exchange inventory, which has been elevated recently, does not decline. Lastly following the 20% y-o-y decline in miner capex 6 months ago, we have an input for the 18-month lagged capex factor in the model. Based on these assumptions, it is our opinion that silver could rise between $22 and $24/oz in 2017,” according to the ETF Securities note featured in Barron’s.

For more information on the silver market, visit our silver category.

iShares Silver Trust (NYSEArca: SLV)