By Doug Sandler, CFA, RiverFront Investment Group Chief U.S. Equity Officer

For nearly 15 years our investment team has utilized ETFs within our global portfolios. We have always viewed ETFs as more than just passive investments, and we firmly believe that ETFs can be utilized as active tools that can be combined in an effort to generate market-beating returns the same way that a traditional portfolio manager may use individual stocks and individual bonds.

This week, we are updating an article we published in 2008, just one month after RiverFront’s founding. The concepts we discussed over eight years ago are just as relevant today and describe the value and importance of ETFs in our portfolio management process.

There are a number of ways we utilize ETFs in portfolio management. Below are a few examples:

Participation: We all recognize that a great investment idea does not come along every day, or every year, for that matter. For this reason, even professional portfolio managers have historically only been able to classify a percentage of their portfolios as “high conviction”. Those holdings not classified this way are often included in the portfolio to merely generate returns commensurate with a specific asset class or sector (beta) and reduce tracking error between the portfolio and its benchmark. One common example is for the portfolio manager to purchase a stock or bond “bellwether” (often the largest company in a sector) in which they lack strong conviction or expertise. Unfortunately, these positions can come at a cost, particularly when they underperform the sectors they were supposed to represent and thus dilute the entire portfolio’s returns. ETFs offer a solution to this problem. ETFs have become a tool for participating in an asset class or sector, since they are constructed seeking to minimize the risk of a single stock underperforming. In our opinion, buying stock or bond bellwethers for beta has become an outdated practice, and one we try to never employ.

Access Previously Inaccessible or Volatile Sectors: From an equity perspective, the highest growth sub-sectors of the market have been the most volatile and thus essentially off-limits to everyone but the largest clients or institutions. Dozens of small positions would be required to appropriately diversify an investment in areas like biotechnology, semiconductors, Internet or alternative energy. The same can be said for high growth asset classes like micro-caps, emerging market stocks and high-yield bonds. In the past, an investor with a portfolio worth less than $1,000,000 would have difficulty participating in the growth of these asset classes or sectors due to position size limitations. Today, non-traditional asset, industry-specific and thematic ETFs make previously inaccessible segments of the market accessible. Of course, these ETFs involve specific risks and costs that financial advisors and clients should be aware of before buying them.

Pure Implementation of Time-Tested Strategies: Many academic articles and whitepapers have been written to highlight investment strategies that have been effective over time, such as the owning stocks with superior relative strength, favoring stocks with low levels of accruals, owning low volatility stocks, etc. However, these strategies are often difficult to implement in a traditional portfolio because a core assumption in the research is that the methodology is implemented across a large number of stocks. In fact, many researchers caution users against selective implementation of their strategies, since company-specific risks can overwhelm the results. Therefore, much of the leading edge investment thinking has been out of reach to all but the most sophisticated and largest institutional investors. We believe ETFs change this dynamic by making these strategies attainable through an individual or combination of ETFs. In our view, ETFs help level the playing field between retail investors and the largest institutions.

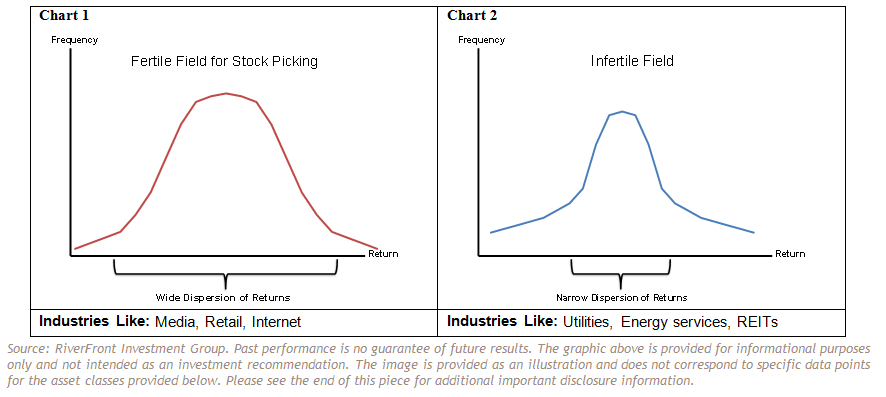

More Efficient Deployment of Resources: Researching stocks is a resource-intensive process whose value varies among sectors and styles. In some sectors, the performance of the constituents is widely disparate, and research and stock-picking can make a meaningful impact (Chart 1). On the other hand, there are places where, in our view, deep research adds little value and the majority of returns are attributable to the sector level (Chart 2). We believe it is important for investors to recognize those sectors with the greatest opportunity to add value and allocate their time and efforts accordingly. Media, Commercial Services and Retail are just a few examples of industries in which returns have historically been widely dispersed. Conversely there are industries in which there is little deviation among company returns; the performance of most of the stocks in these industries largely reflects the industry-average returns, with minimal variance between the best performers and worst performers. In tightly dispersed industries, such as utilities and beverages (see Chart 2), we believe the decision whether to be overweight or underweight the industry is generally more important than the actual stocks that one might select.

Caveat: While on paper widely dispersed industries, like those in Chart 1, appear to be a stock picker’s “paradise,” this is not always the case. A stock picking paradise can potentially be a mirage and ultimately end up as a very dangerous place to invest. In our view, dispersion only tells part of the story regarding the likelihood of stock-picking success. In many industries where performance has historically been widely dispersed, that composition of return has been made up of a large number of losers and only a handful of winners (Chart 3). For example, many companies in the biotechnology industry ultimately fail (for a variety of reasons). However, what makes biotechnology attractive as an industry, in our view, is the fact that a few companies are ultimately successful, and that success can more than offset the numerous losses incurred by those companies that fail. As a result, we believe that in biotech many investors are better off utilizing an ETF because a basket approach (i.e., owning a group of companies in the same space) can increase the odds that potential “winners” are in the portfolio to offset potential “losers.” On the other hand, there are sectors or industries that have opposite characteristics. These areas are more likely to have one or two big detractors that if avoided can lead to outperformance (Chart 4). In our view, the right area to stock-pick are those where the dispersion of returns has historically been wide (Chart 1) and there is a greater opportunity to capture those returns (Chart 4).

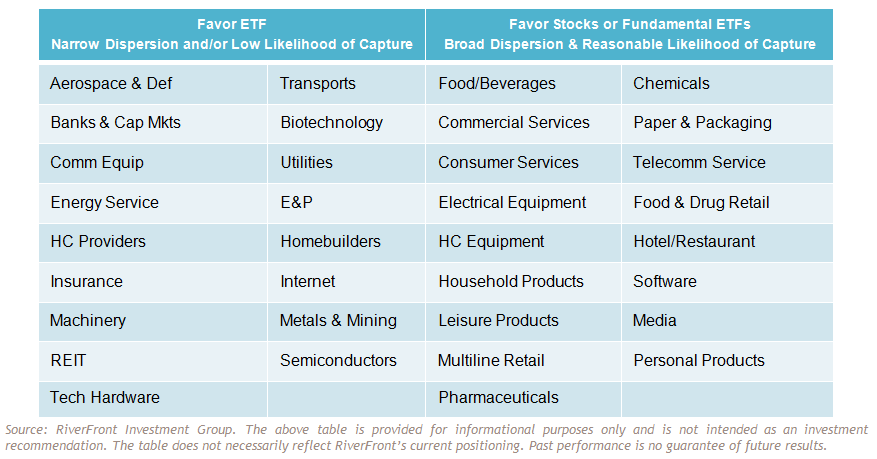

In table 1, we separated the major S&P industry groups into two categories based on our opinion and the industry’s historical performance. The table displays those industries where we tend to favor ETFs when constructing our portfolios and those industries where we prefer to use stock-picking or more fundamental ETFs.

Table 1: Where We Favor ETFs and Where We Favor Stock-Picking

Doug Sandler, CFA, is Chief U.S. Equity Officer at RiverFront Investment Group, a participant in the ETF Strategist Channel.

Important Disclosure Information: