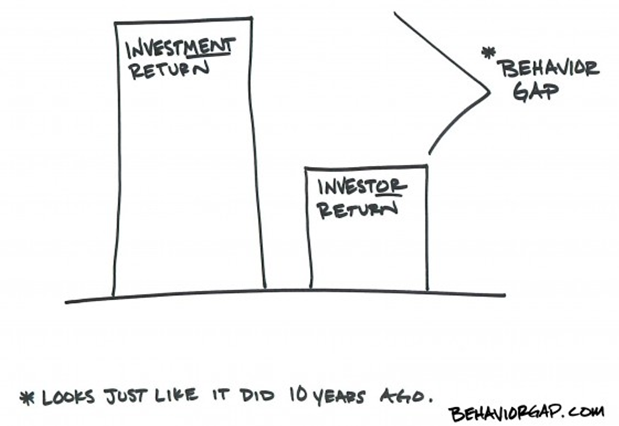

Carl Richards, the founder of Behavior Gap, visually depicts bad investor behavior with the following two graphs:

Maintaining a static asset allocation will help with this problem, but not solve it – after all, if you never trade, you can’t make bad trades. But smart investors realize that there is opportunity to add value by rebalancing underperforming assets back to their targets, or by strategically adjusting exposure to various asset classes over time.

The difficulty often lies in the slippery slope between static allocations and market timing. While we don’t encourage investors to maintain static allocations that never adjust, we likewise don’t encourage investors to employ active market timing. We feel the sweet spot is to be in between those two extremes, a process we call A Strategic Approach to Active Indexing™.

Disciplined strategic investing can lead to desirable results. For example, investors who diligently purchased emerging markets or commodities over the past few years have been rewarded as those asset classes have rebounded this year. The iShares MSCI emerging markets ETF (EEM) was down 3.7% in 2013, down 3.92% in 2014, down 16.18% in 2015, but is currently up 17.25% year to date as of September 30th.

Conclusion

Setting a base for successful long term investing can be simple. Likewise, investors should avoid investment strategies that do not utilize asset allocation, low cost vehicles, and discipline. However, investing is not easy and we encourage investors to select proven investment strategies designed to achieve long term success.At times the boulder can feel heavy and difficult to move, but these principles can help provide the strength to continue to make progress towards the goal.

Ryan Gilmer, CFA, is VP Investment Management at TOPS/ValMark Advisers, a participant in the ETF Strategist Channel.

Important Disclosure

IVE, VEU and VWO have been, may be and/or are currently held in several TOPS Portfolios.

ValMark Advisers, Inc. (“ValMark”) is a federally registered investment adviser located in Akron, Ohio. ValMark and its representatives are in compliance with the current registration and notice filing requirements imposed upon federally covered investment advisers by those states in which ValMark maintains clients. For registration or additional information about ValMark, including its services and fees, a copy of our Form ADV is available upon request by contacting ValMark at 1-800-765-5201.

This article provides commentary on current economic and market conditions and is not directly relevant to any particular client account. The information contained herein should not be construed as personalized investment advice or recommendations to buy or sell any security. There can be no assurance that the views and opinions expressed in this article will come to pass. Investing involves the risk of loss, including the loss of principal.

Past performance is no guarantee of future results. Information contained herein is subject to change without notice and should not be considered as a solicitation to buy or sell any security. Indexes are unmanaged and cannot be directly invested in.

Diversification cannot assure a profit or guarantee against a loss.

Source: Bloomberg for historic price and return references.

TOPS® is a registered trademark of ValMark Advisers, Inc.