By Sauro Locatelli

Quantitative Analyst, Pinnacle Advisory Group

Real Estate Investment Trusts (REITs) are joining the big leagues, at least as far as the Global Industry Classification Standard (GICS®) is concerned. REITs have traditionally been considered a sub-industry and part of the Financial sector, but as of the market close on August 31, 2016 (and effective September 16, 2016), they will split from the Financial sector and get promoted to sector status (with the exception of Mortgage REITs, which will remain part of the Financial sector). This should not be a surprise for investors, as the change had been announced by index providers S&P Dow Jones Indices and MSCI back in March 2015. Nonetheless, the change is likely to cause at least some headaches.

What are REITs?

Under U.S. Federal income tax law, a REIT is “any corporation, trust or association that acts as an investment agent specializing in real estate and real estate mortgages”. Therefore, a REIT is a company that owns, and in most cases operates, income-producing real estate. REITs own many types of commercial real estate, ranging from office and apartment buildings to warehouses, hospitals, shopping centers, hotels and even timberlands. Created by the U.S. Congress in 1960, REITs were designed to provide a real estate investment structure similar to the structure mutual funds provide for investment in stocks. As such, they provide investors with a convenient and liquid way to invest in real estate. Because a REIT is entitled to deduct dividends paid to its investors, a REIT may avoid incurring all or part of its liabilities for U.S. federal income tax. The purpose is to avoid double taxation of the income produced by the underlying properties. In return, REITs are required to distribute at least 90% of their taxable income into the hands of investors. This makes REITs a particularly interesting product for income-oriented investors and has contributed to their popularity in recent years.

Why are REITs becoming a sector?

Back in 2001, REITs represented about 0.11% of the market capitalization of the S&P 500 index. Today, that figure has soared to over 3%. While 3% may not sound overly impressive, it is roughly comparable to the size of three other sectors of the S&P 500 index (specifically Utilities, Materials, and Telecommunications). The decision to promote REITs to sector status is a social commentary that REITs are very grown up. Indices are supposed to reflect the composition of the economy, and REITs are now a big part of it.

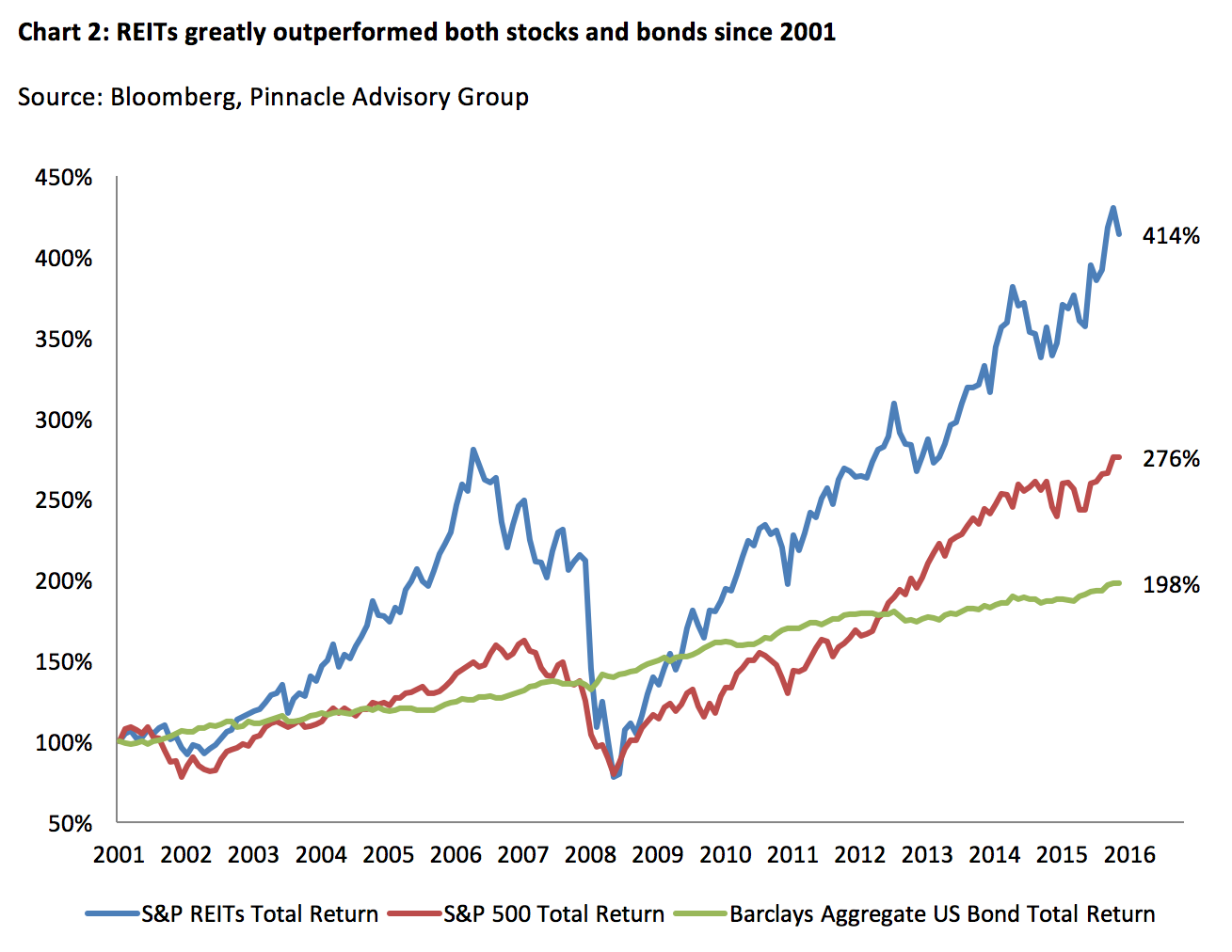

The weight of REITs in the S&P 500 index is not the only thing to have grown exponentially in recent years, as the popularity of REITs among the investment public, both institutional and retail, has also exploded over the last decade or so. That is not surprising considering how REITs have performed over the same time frame. Since 2001, REITs have produced a cumulative return of 414%, greatly outperforming both the S&P 500 index and the Barclays Aggregate US Bond index. Moreover, REITs typically carry a high dividend yield (currently around 4% for the S&P REITs index, which is nearly twice that of the S&P 500 index), which makes them particularly attractive for yield-starved investors in the current very low yield environment.