Click to enlarge:

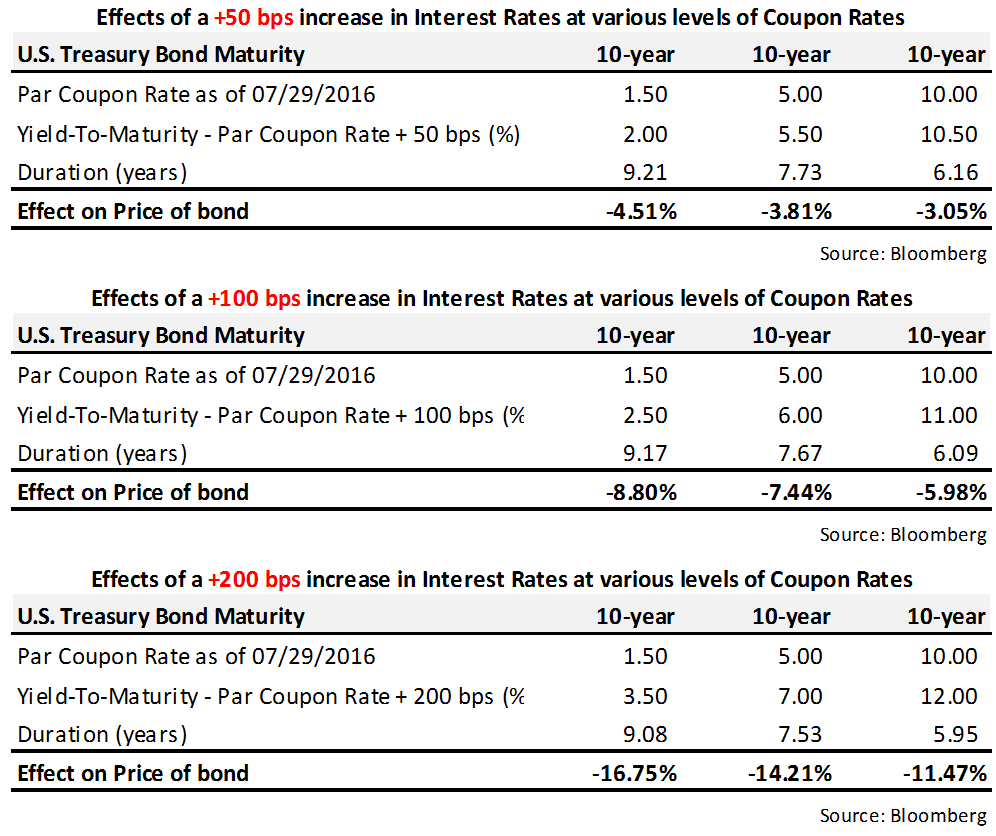

Additionally, the bond coupon rate also affects the duration of the bond, i.e. when comparing bonds of the same tenors, the lower the coupon rate of a bond, the longer its duration, and thus the higher its price sensitivity. The tables below show how interest rate hikes of +50 bps, +100 bps, and +200 bps will have an impact on the price of three 10-year U.S. Treasury Bonds with varying coupon rates of 1.50%, 5.00%, and 10.00%.

Click to enlarge:

Hence, if you are considering investing in a very low coupon bond while attempting to push the maturity of that bond further out on the yield curve to obtain a higher yield, you should be mindful that it is a highly speculative trade and one that can quickly turn on you when interest rates start to rise. The combination of a low coupon rate and a long-dated maturity bond is highly price-corrosive. As a corollary, to avoid realizing a capital loss on the bond investment, the investor would have to hold the bond to maturity in exchange for an ultra-low coupon payment.

Lower Credit Quality

Bonds are rated according to their creditworthiness and their ability to pay principal and interest on time. Default risk is the chance that an issuer of the debt will be unable to pay its obligations when they fall due. Bonds that have a high risk of default are often referred to as speculative, non-investment grade, junk, or high-yield bonds.

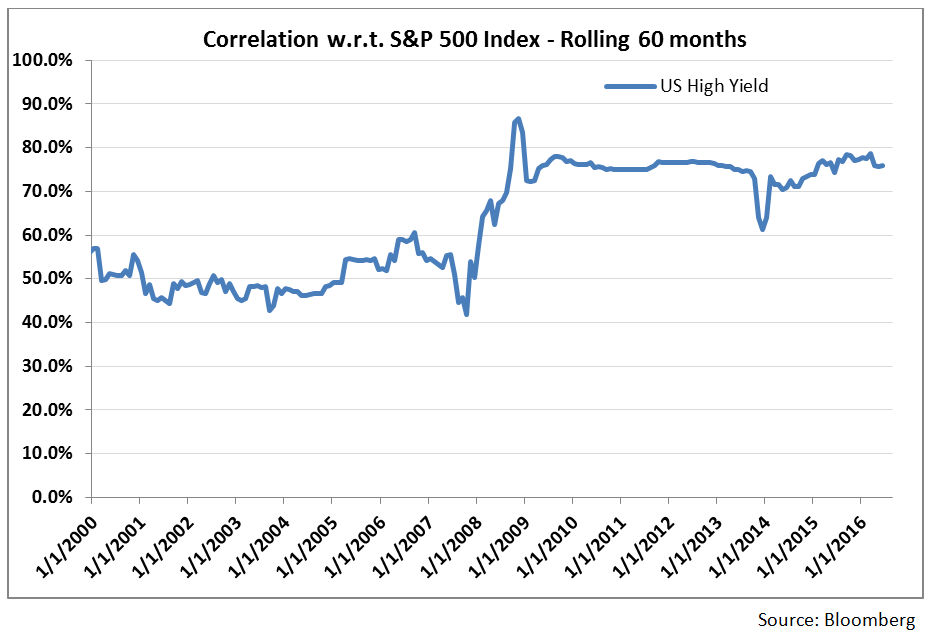

The lower the credit quality of the bond, the higher its sensitivity to default risk. Investors should expect a higher recompense (yield) from the bond issuer, the lower the credit quality. But spreads between high-yield bonds and their risk-free counterparts have narrowed substantially, distorting the risk-to-reward payoff, i.e., skewing the profile towards more risk and less reward. Hence, this is where most investors chasing yield may get themselves into trouble. In addition to increasing the risk of default, the investor would also be increasing the correlation of the bond portion of the portfolio to the stock market. As shown in the graph below, the correlation of high-yield bonds with the S&P 500 Stock Index is in the neighborhood of 80%. This high level of correlation can severely compromise one of the principal purposes for holding bonds in a portfolio — diversification.

Click to enlarge:

Diminishing Carry

With investors pushing out further on the yield curve, it has caused the bond yield curve to flatten. Spreads between different-tenored maturity bonds have narrowed dramatically in the U.S., and therefore, profiting from these bonds may be undependable as they roll down the yield curve. There is little appeal for investors in the “carry” of long-dated bonds as they roll down a flat yield curve within the context an ultra-low yield environment. It would take rates to go significantly lower to be able to come out ahead on the investment. The situation creates an unfavorable prospect for bonds and effects a vicious loop, i.e. to generate any gains from these long-dated bonds (whether it is from capital gains and/or total return), bond yields would have to fall lower and faster, and if bond yields were to fall lower, investors would have to venture further out on the yield curve to chase higher yields. Said another way, if long-term interest rates rose, the situation would swing from a positive “carry” or break-even on the bond to becoming an unprofitable investment.

Conclusion

Generally, fixed income securities such as bonds, which have traditionally had lower volatility than stocks and have provided a high diversification benefit to a portfolio, have become more speculative as investors reach for incremental yields in an ultra-low interest rate environment. In one of our earlier publications, RMI and Investing in a Rising Rate Environment, we highlighted the problem investors will encounter with fixed income investments in a conventional 60/40 mix portfolio, and how Risk-Managed Investing (RMI) can be an elegant solution to successfully manage equity risk explicitly and rely less on bonds to dampen portfolio volatility.

This article was written by Gladys Chow, Managing Director and Portfolio Manager, and Jerry Miccolis, Founding Principal and Chief Investment Officer, of Giralda Advisors, a participant in the ETF Strategist Channel.

This material is for informational purposes only. Nothing in this material is intended to constitute legal, tax, or investment advice. Investing involves risk including potential loss of principal.

Giralda Advisors, located in New York City, is an asset management firm that focuses on providing risk-managed exposure to the equity markets with a goal of limiting asset depreciation during both protracted and catastrophic market downturns while allowing substantial asset appreciation in up-trending markets. The Giralda Advisors team welcomes your inquiries. Call (212) 235-6801 or visit http://www.giraldaadvisors.com/.