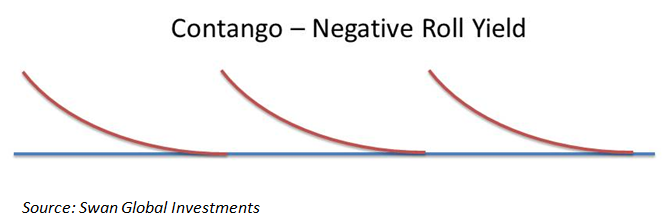

Instead, most products that try to capture the VIX movements do so via the use of short-term futures. Futures are of course another type of derivative, so a future on the VIX is really a derivative of a derivative. Futures have their own unique pricing complexities. In the case of VIX futures, the futures almost always trade at a premium to the VIX, a situation known in the futures market as “contango”.

Because these are short-term contracts, a VIX futures strategy must constantly be buying futures that are almost always more expensive today than they will be in the future. In practical terms, this means consistently maintaining a position in VIX futures will almost always lose money.

In addition, most volatility ETPs are passively managed. This is tricky when volatility conditions change extremely fast. Anyone who has kept an eye on daily movements in the VIX or related ETPs knows that double-digit daily moves are not uncommon. Yet many volatility ETPs are methodically managed in a passive fashion and are not designed to react to changing market conditions.

Finally, the very fact that the prices of volatility ETPs are so volatile themselves make them inappropriate as a long-term investment vehicle and impractical as a hedging vehicle. As discussed in a previous Swan article for ETF Trends (link), variance drain deteriorates the long-term value of any investment. Generally speaking, the more volatile an asset and the longer the holding period, the more variance drain will diminish its value. Since volatility ETPs are so volatile, the impact of variance drain is especially pronounced.

If one intends to use volatility ETPs to profit from volatility, the time horizon must be very short – not much longer than a few days or weeks, in most cases. The factors discussed – contango, passive management, and variance drain – make volatility ETPs a poor choice for hedging or long-term investing.

Related: Math Matters: Rethinking the Calculations Behind Investment Returns

However, if one wishes to harvest the so-called volatility premium over longer time horizons, it is the opinion of Swan Global Investments that you need to do so directly. If you want to profit from the fear and volatility that is priced into current options, you must trade the options themselves. Also, given how quickly things change in the options market, it is essential to have active management and strict risk controls in place to mitigate and manage the risk of a volatility capture strategy. This approach to premium harvesting is one of the components of Swan’s Defined Risk Strategy (DRS). For 19 years the DRS has systematically attempted to collect the volatility premium by selling out of the money calls and puts on the S&P 500. The DRS combines volatility capture, long exposure to the market via ETFs, and effective hedging techniques in a single strategy designed to provide consistent returns throughout rising, declining, or flat markets.