Minimum Volatility Valuations Only Matter at Extremes

Valuations for minimum-volatility securities are not always the perfect indicators of future returns. Why is this the case? During periods of market stress, investors are sometimes willing to pay “any price” in order to protect their wealth which can be to their detriment. In fact, after adjusting for valuation levels, minimum-volatility securities tend to outperform when valuation levels are fairly normal or higher than average, except when they are at statistical extremes. Currently, minimum-volatility valuations sit right in their normal range relative to their long-term historical averages.

Source: MSCI, CLS Investments. Data from 6/30/1994 – 5/31/2016. Valuations for MSCI USA Minimum Volatility Index based on Price-to-Book.

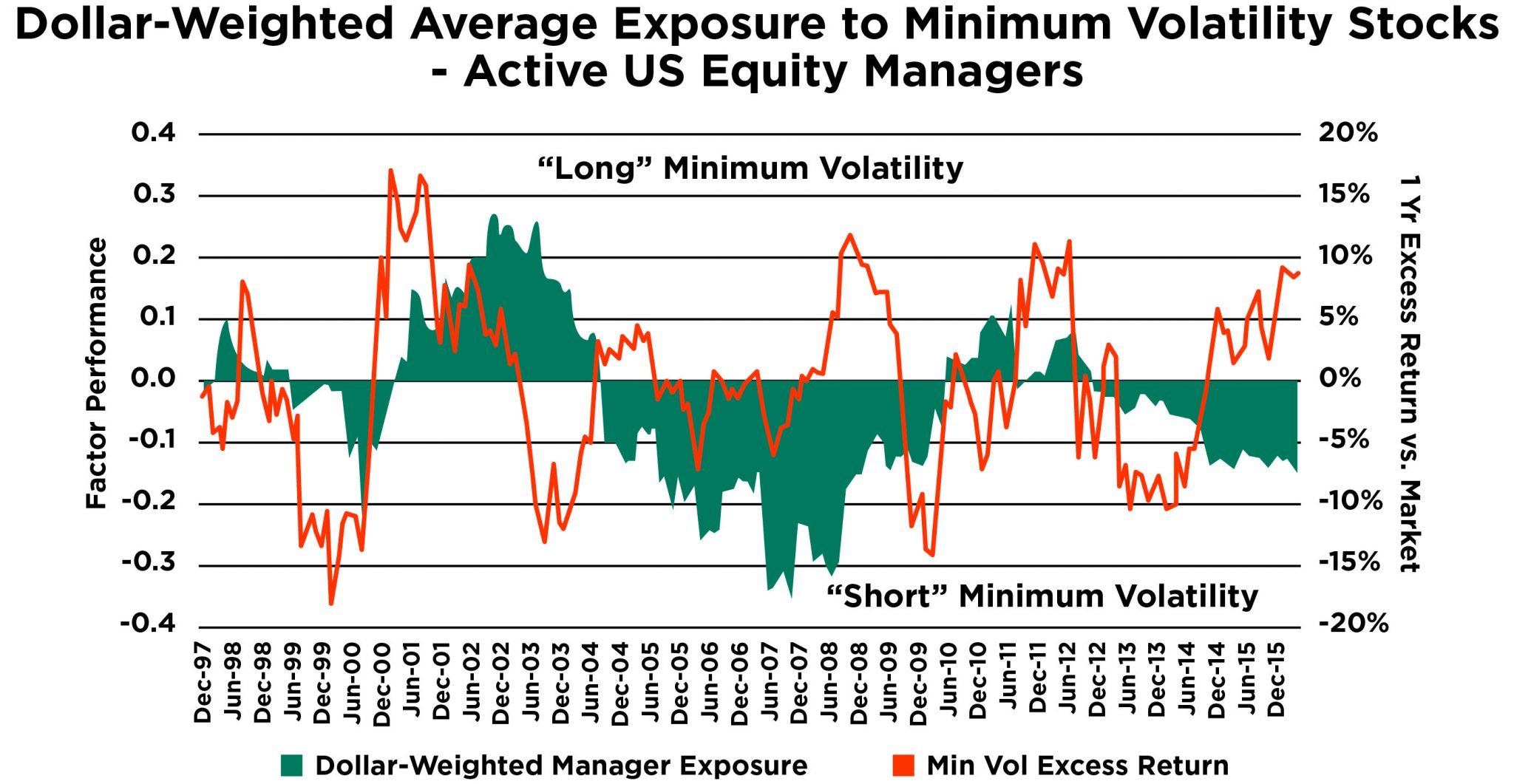

Active Managers Are “Short” Minimum Volatility Stocks

In order for something to be considered crowded, a broader majority of investors, not just those buying and selling minimum-volatility ETFs, have to participate in the same trade. The dollar-weighted average exposure of active U.S. equity managers to minimum volatility would suggest they mostly have fairly negative exposure to this trade. The exception has historically been during the peak periods of minimum volatility’s cycle — namely when market stress has already played out in the market. Today, most managers are currently underexposed, or effectively short, minimum volatility stocks right as they are breaking their stride and outpacing the market.

Sources: Morningstar Direct, MSCI, FTSE/Russell. Data from 12/31/1994 – 5/31/2016. Analysis of rolling 3 year regressions of manager returns against 6 factors (Market minus Cash, Small minus Large Stocks, Value minus Growth, Momentum minus Parent index, Minimum volatility minus Parent Index, Quality minus Parent Index). 271 US equity manager A share class funds considered with performance available back to 12/31/1994. Market represented by Russell 3000. Small and Large Caps represented by Russell 2000 and Russell Top 200. Value and Growth represented by Russell 3000 Value and Russell 3000 Growth. All other factors represented by MSCI USA Factor Indexes and compared to MSCI USA.

Minimum Volatility ETFs May Not Be So Crowded After All

So what is the point of all of this? Having a complete view on minimum volatility as a factor has to go beyond one or two inputs to make an informed decision. Investors should look to more tangible bits of evidence across all market participants to determine if a trade has become crowded or not. Without monumental shifts in behavioral biases and thinking by investors (namely the classic trade-off between risk and return), it is more probable that the premium for minimum-volatility stocks will continue to persist — not disappear.

Joe Smith, CFA, is a Senior Market Strategist at CLS Investments, a participant in the ETF Strategist Channel.