Related: Analyzing How Global Markets are Grinding Higher

At a high level, nominal GDP is driven by growth in the labor force, plus productivity growth and inflation. We expect the U.S. labor force to advance about 0.5% per year, productivity growth to advance at about 1%, near the low end of its historical range, and inflation to be about 2%. That would equate to a nominal GDP of approximately 3.5%.

We think that 3.5% is a close approximation for S&P 500 Index revenue growth now that the U.S. dollar and the price of oil, as well as other industrial commodities, have stabilized compared to their recent volatility. With these headwinds behind us, we expect to see the gap between NGDP and S&P 500 Index revenue to narrow as revenues increase.

Following revenue growth, we expect earnings growth to move into positive territory over the next few quarters, but to remain challenged by increasing wage pressure. As wage pressure grows, margins should continue to compress. With a dividend yield of approximately 2%, and little room for valuation expansion, this translates into a muted total return potential for U.S. equities in the near-term, in our opinion.

Related: Seeking Excess Returns While Managing Risk in Fixed Income

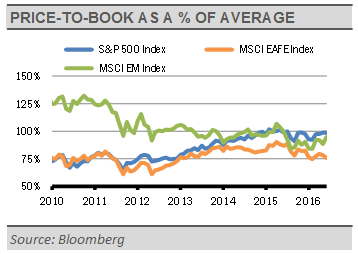

While we think that domestic equity returns may be challenged, we think that foreign equities offer interesting opportunities with an emphasis on earnings consistency and dividend yield. While domestic equities are generally priced near their historical valuation, based on price-to-book ratio, foreign developed and broad emerging markets continue to trade at a discount. As the global economy stabilizes, investors may seek better valuation opportunities overseas.

Importantly, we think that putting risk first is still the best course of action, and those that focus only on potential return and downplay risk will likely be punished in this environment. Managers like us, who have the ability and willingness to adjust risk profiles in anticipation of shifting market conditions, can play a major role in helping investor navigate these markets.

Gary Stringer is the CIO, Kim Escue is a Senior Portfolio Manager, and Chad Keller is the COO and CCO at Stringer Asset Management, a participant in the ETF Strategist Channel.