Note: This article appears on the ETFtrends.com Strategist Channel

By Chris Konstantinos

“Darlin’, you got to let me know/ Should I stay or should I go?” – The Clash, a celebrated British punk band

Britons are awaiting June 23 with baited breath – and it’s not because that date marks the birthday of King Edward VIII (who ruled England for less than a year back in the 1930s). Rather, June 23 is the day of the UK’s historic referendum vote on whether to exit the European Union (EU) – “Brexit”, in market parlance. This vote carries major implications for both the UK and the rest of the world, so market focus will only intensify in the last two weeks. In this piece, we will discuss why Brexit might occur, its likelihood, its potential implications for the UK economy and risk markets, and Riverfront portfolio strategy if it comes to pass.

WHY DO SOME UK CITIZENS WANT TO EXIT THE EUROPEAN UNION?

The complaints of the “Leave” camp (as personified by London’s colorful former mayor Boris Johnson) are generally cultural and geopolitical. They argue the UK overpays for membership in an overregulated trade bloc, that UK interests are often steamrolled by the EU, and that the UK would have better control of their own borders and safety on their own. This acrimony comes as no surprise; the UK’s relationship with the rest of Europe has been a complicated one for centuries. In fact, since Britain’s referendum for inclusion into the European Commission in 1975, Britain’s role has remained contentious.

On the other hand, the “Remain” camp, which includes the Prime Minister, Chancellor, most UK employers, the Bank of England, and a host of non-partisan economic think-tanks, argue that Brexit is calamitous for the UK economy. The OECD argues that the UK’s potential GDP would be reduced by 3 percentage points by 2020 should Britain leave – suggesting the cost of Brexit is equivalent to approximately ₤2200GBP per UK household. Longer term, this deteriorates to a 5% reduction by 2030 in their base case scenario (see chart below).

The OECD’s forecasts above are based in the potential for decreased trade, the possibility of capital outflows, the cost of higher corporate bond spreads due to uncertainty, and the risks that all the above could damage business and consumer spending as well as foreign direct investment. In addition, the OECD suggests that the positive benefits the UK has experienced historically from immigration would also be reduced going forward. This is important, as by their estimates, immigration accounts for one-half of UK GDP growth since 2005.

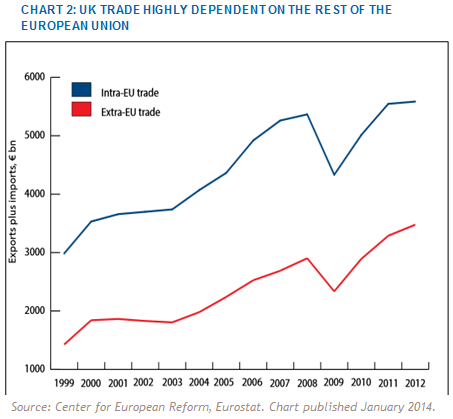

Regarding RiverFront’s opinion, we are ideologically in the “Remain” camp, as well. Our view is based primarily on the fact that Britain is greatly dependent on the rest of the EU for trade. According to the Centre for European Reform, as of 2012 the EU represented approximately half of the UK’s total trade (see Chart 2 below), a huge number in our opinion. Put another way, we think the UK needs the EU more than the other way around, and thus anything that disrupts trade into the EU will diminish UK productivity and growth. Under Brexit, the UK will be forced to renegotiate trade pacts on contentious terms with the EU over the two year post-Brexit grace period. Also likely in this scenario are Conservative party rifts (and maybe even a new election). Both of these reactions would create uncertainty, which equity markets do not like.

HOW LIKELY IS BREXIT?

Public opinion polls suggest a vote coming right down to the wire. The Financial Times’ poll of polls on Brexit suggests 45% for Remain, 43% for Leave, and a large 12% still undecided (ft.com, 6/10/16). But, if markets learned anything from the Scottish referendum vote on UK membership last year, it’s that it is dangerous to place too much trust in popular opinion polls. In that case, although public polling suggested a close vote, in the end an overwhelming majority of Scots voted to stay. The history of referendums suggests that people may talk with their heart but tend to vote with their head in the anonymity of the voting booth.

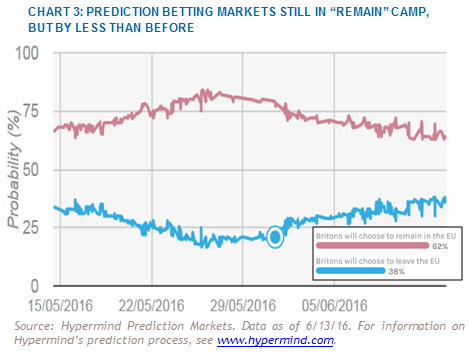

At this point, professional bookmakers and crowd-sourced prediction betting markets place the odds of Brexit lower than polls – roughly 60% probability of “Remain” vs. 40% “Leave” at the time of this writing, depending on the source.

Related: Eurozone: Ugly Headlines, Resilient Data

Our own internal probability of Brexit aligns more closely with the bookmakers’ views, but we acknowledge that it’s impossible to rule out Brexit given the potential for public debate or something exogenous – scandal, geopolitical event –that could meaningfully change public opinion between now and June 23rd. Interestingly, UK credit default spreads (the cost of protection against a credit event in UK sovereign bonds), while elevated relative to last summer, have been contracting since April, suggesting the market’s view of Brexit spillover risk to sovereign credit has actually been decreasing. Similarly, credit default swaps (CDS) in large Eurozone countries thought to be political “flight risks”, such as Spain, have also stayed range-bound recently, and at much lower levels than during the 2011-12 Eurozone split scare.

HOW MIGHT MARKETS RESPOND IN THE EVENT OF BREXIT?

Likely Market Effect: Negative everywhere, but acutely felt in the UK. In the event of Brexit, we believe there would be a near-term increase to the risk premia across all European markets, and probably risk assets in general. We believe markets would likely start to further extrapolate not only lower economic growth in the UK and in the Eurozone, but also more political uncertainty for other nations with fringe political issues surrounding continued membership in both the EU and the Eurozone.

We believe near-term dislocation would be particularly acute within the UK, where political uncertainty around Prime Minister David Cameron’s future would add to economic concerns. For consumer-facing companies, post-Brexit uncertainty will likely lead to a negative effect on both UK consumer spending habits and business confidence. Indeed, there is some evidence that uncertainty over Brexit has already started to have an effect, with a recent slowdown in the CBI UK Industrial Trends and Consumer Services Surveys (source: Ned Davis Research).