Note: This article is part of the ETF Trends Strategist Channel

By Joe Smith

Multi-Factor Investing is on the Rise

Multi-factor investing is an increasingly hot topic in the world of ETFs, and a number of ETF sponsors have launched multi-factor ETFs recently to expand on this trend.

Multi-factor ETFs aim to intelligently combine a well-known set of factors, such as Size, Value, Momentum, Minimum Volatility, and Dividend Yield in the formulation of an investable portfolio that benefits from harvesting these risk premiums over longer time horizons. In addition, the benefit of diversification across these factors should deliver superior risk-adjusted returns than traditional benchmark alternatives.

Bayesian Framework of Factor Performance

If history is a guide, then we can look to factor combinations that have traditionally worked better together to further improve upon the current equal-weighted case across factors.

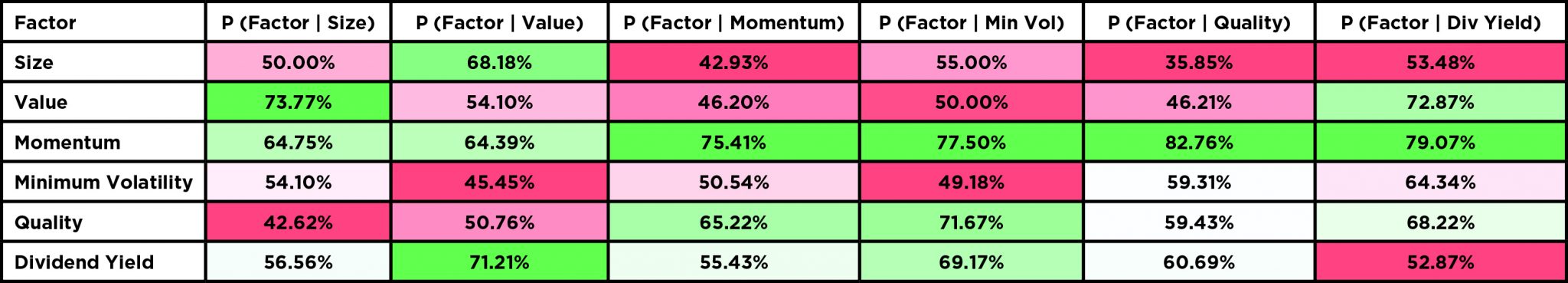

We take a Bayesian view to factor investing to discover insights associated with certain combinations of factors at various periods of outperformance relative to the global equity markets. More specifically, we evaluate the probability of a factor outperforming the benchmark over a one-year window if another factor has outperformed the benchmark over the same time frame.

Which Factor Pairs Work Best Together?

Looking at the results, we find a few points of note. In isolation, Momentum on average has the highest probability of outperforming the benchmark over a rolling one-year period, a success rate of 75% irrespective of other factors. Every other factor’s individual success rate falls to 50-59% with the exception of Minimum Volatility, whose rate is just shy of 49%.

Even more important to note are the comparative results of factors that have worked when others have too. Value shows a success rate of 74% when Size also has outperformed. When Value outperforms, Size succeeds at a lesser rate of 68%. Dividend Yield has a 71% success rate of outperforming when Value outperforms, but Value is only 53% successful in outperforming when Dividend Yield outperforms.