The current environment for high yield bonds is still attractive in our opinion. The current spread on high-yield bonds versus Treasuries is about 556 basis points, slightly more attractive than the 499 basis point average since 1983.

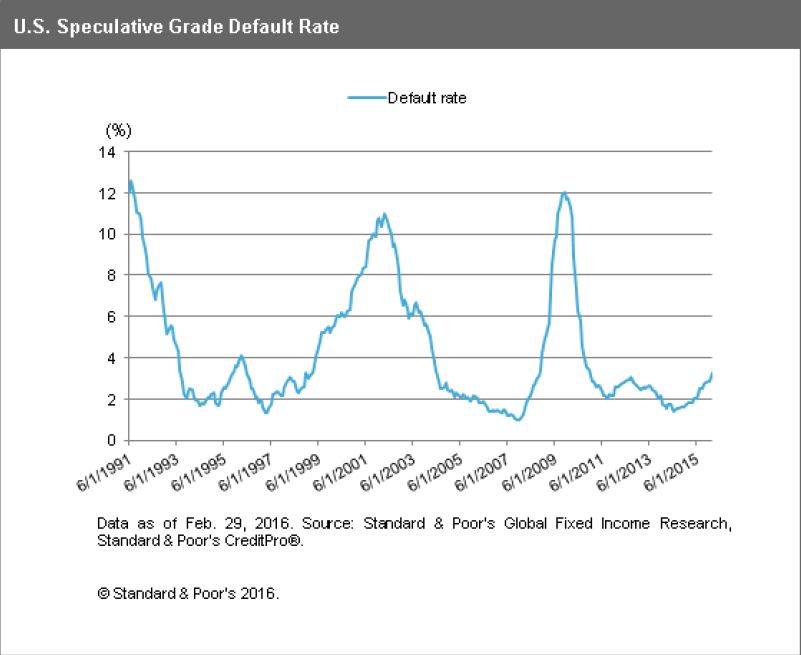

Despite the carnage in the energy sector, default rates were only about 3.8% at the end of the first quarter, far better than the 12% level experienced in 2009.

There are no magic potions in the investment arena, but the thoughtful use of high-yield bonds in the right dosage in your portfolio may be just what the doctor ordered.

Glenn S. Dorsey, CFA, is the SVP, Client Portfolio Manager, at Clark Capital Management Group, a participant in the ETF Strategist Channel.

Disclosure Information:

Past performance is not indicative of future results. This is not a recommendation to buy or sell a particular security. The opinions expressed are those of the Clark Capital Management Investment Team. The opinions referenced are as of the date of publication and are subject to change due to changes in the market or economic conditions and may not necessarily come to pass. Clark Capital reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs. There is no guarantee of the future performance of any Clark Capital investment portfolio. It should not be assumed that any of the investment recommendations or decisions Clark Capital makes in the future will be profitable or equal the performance of the securities discussed herein. Material presented has been derived from sources consider to be reliable, but the accuracy and completeness cannot be guaranteed. The investment strategy or strategies discussed may not be suitable for all investors. Investors must make their own decisions based on their specific investment objectives and financial circumstances.

Clark Capital Management Group, Inc. is an investment adviser registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training. More information about Clark Capital’s advisory services can be found in its Form ADV, which is available upon request. CCM-978