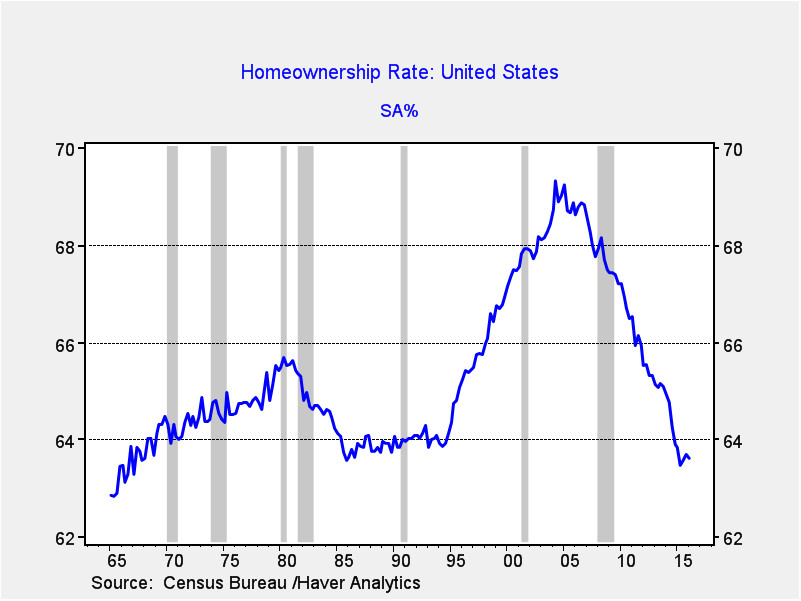

A major reason rental income is rising is due to falling homeownership rates.

The rate of home ownership peaked at 69.3% in Q2 2004 and, in the wake of the housing crisis, suffered a precipitous decline. Although we have reached a level where we believe stabilization is likely, we doubt this level will rise anytime soon. And so, rental income should remain elevated until enough new apartments are constructed to depress rents. So far, that hasn’t happened, although there has been an increase in multi-family construction. We will continue to closely monitor rental income as a key input into our REIT allocations.

Bill O’Grady is an Executive Vice President and Chief Market Strategist and Kaisa Stucke is an Investment Strategist, both at Confluence Investment Management, a participant in the ETF Strategist Channel.

Past performance is no guarantee of future results. Information provided in this report is for educational and illustrative purposes only and should not be construed as individualized investment advice or a recommendation. The investment or strategy discussed may not be suitable for all investors. Investors must make their own decisions based on their specific investment objectives and financial circumstances. Opinions expressed are current as of the date shown and are subject to change.