I would bet that when most people hear high yield, they think of corporate bonds issued by mainly U.S. companies with below investment grade credit ratings. The benchmark ETFs in this space are the SPDR® High Yield Bond ETF (ticker: JNK) and the iShares iBoxx $ High Yield Corporate Bond ETF (ticker: HYG).

However, there are a number of smaller high yield ETFs that can be used to diversify exposure by duration (e.g. SPDR® Barclays Short-Term High Yield Bond ETF: SJNK), sector (e.g. Market Vectors High Yield Municipal ETF: HYD; PowerShares Senior Loan Portfolio: BKLN), or geography (e.g. Market Vectors International High Yield Bond ETF: IHY; Market Vectors Emerging Markets High Yield Bond ETF: HYEM).

All of these high yield flavors offer attractive yields.

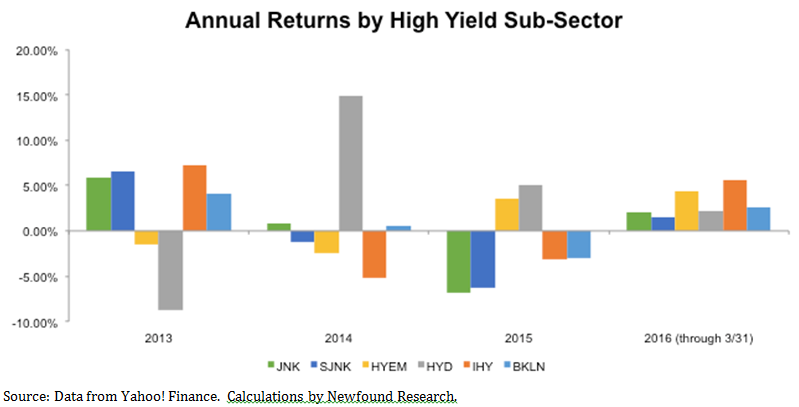

But perhaps more importantly, we see that the best and worst performers vary significantly over time.

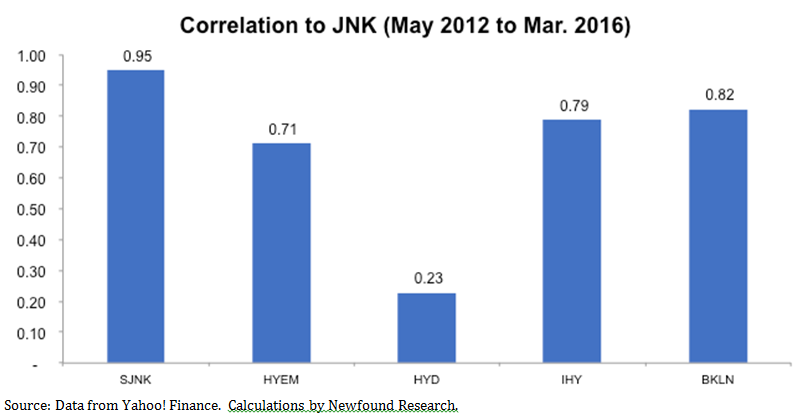

The diversification benefit is most apparent with high yield municipals (ticker: HYD), which only had a correlation of 0.23 to JNK over the period we considered. To put this into context, JNK was more correlated to the Barclays Aggregate Bond Index over this period.

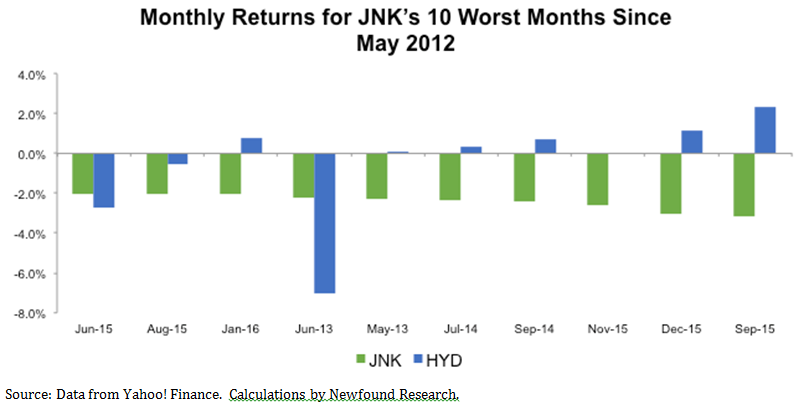

If we narrow our focus to the ten worst months for JNK over the period, the results get even more interesting. HYD outperformed JNK in 8 of these 10 months and was outright positive in 7 of the 10 months.

Higher yielding, Satellite Fixed Income asset classes offer investors the potential to increase total returns via income. However, the allure of higher income usually comes with increased risk. Fortunately, ETFs offer the opportunity to access this income in a diversified manner. Even within one asset class like high yield bonds, there is the opportunity to diversify risk by expanding into differentiated parts of the market like municipals, international bonds, and bank loans.

Justin Sibears is the Managing Director, Portfolio Manager at Newfound Research, a participant in the ETF Strategist Channel.