Another, often-less-cited reason for ETF growth has been actual performance differentials between ETFs and mutual funds. Recent publicity regarding active manager underperformance has undoubtedly led more investors to consider indexing, from which ETFs stand to benefit.

A simple analysis of the largest Morningstar categories indicates performance has recently favored ETFs, as ETFs are outpacing mutual funds in three-year performance in all of the largest categories except world stock.

Interestingly, in the largest domestic equity categories, ETFs have managed to outperform by roughly the typical mutual fund fee for the past three, five, and 10 years.

What is Next?

The future of ETFs, and the broader exchange-traded product (ETP) universe, is bright. The structure of ETPs continues to morph. The impact of ETMFs is of course not certain but will likely have important ramifications for the investment management industry.

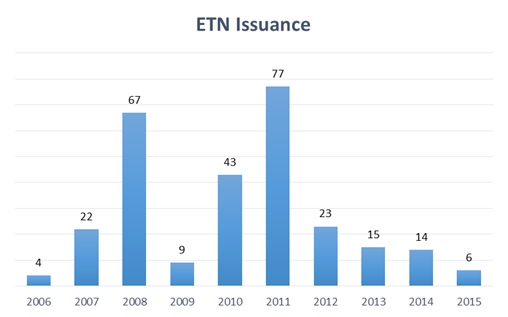

Exchange-traded notes (ETNs) have seen a significant decline since 2011 in yearly issuance, with 2015 as the second lowest year on record.

A combination of new fund structures (Cayman Islands), low commodity prices (many ETNs are commodity-based), and indications from major issuing banks that they no longer want ETNs on their books have all contributed to the decline. Potential SEC regulation on derivatives could re-ignite ETN issuance, although it’s possible the partnership structure would be preferred versus an ETN for levered products.

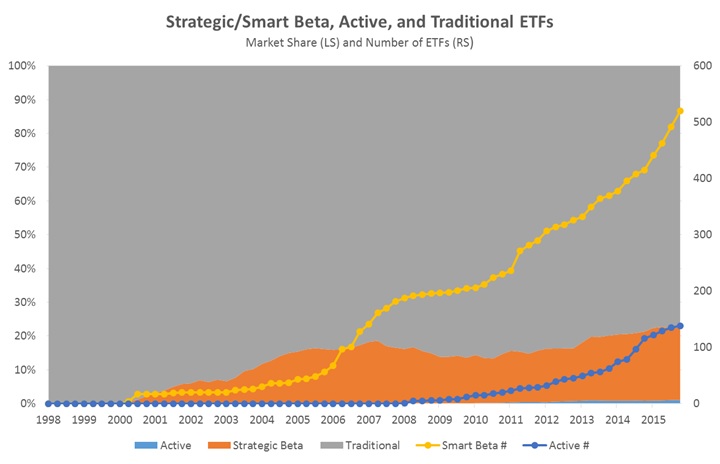

On a more positive note, growth is widely expected to continue in strategic/smart beta and actively managed ETFs. Issuance of these ETFs continues to climb as do filings for future issuance. Strategic beta ETFs are gradually gaining market share versus their more traditional peers; however, active ETFs have only just begun to gather assets, particularly outside the fixed-income space.

Besides the benefits of ETFs, a key ingredient in their exponential growth has been the creativity of ETF issuers. From launching esoteric ETFs that provide access to previously inaccessible countries or strategies, to continued innovation in the strategic beta universe, ETF issuers have impressed with their flexibility and thought behind many of the issuances. Of course, there will definitely be periods of consolidation and changes in regime (you can’t currency-hedge everything, can you?) but I can’t wait to see what the next leg of ETF growth brings.

Grant Engelbart is a Portfolio Manager at CLS Investments, a participant in the ETF Strategist Channel.