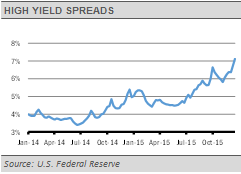

Over the past few weeks leading up to the end of 2015, we have experienced a pick-up in volatility in the fixed income markets. This volatility is most evident within the high yield sector, which has been under stress throughout the year. This stress, coupled with the end of nearly seven years of zero rates and indications that we could see more rate hikes in 2016, has pulled a lot of attention onto the fixed income market and raised many questions regarding how to allocate within the asset class. The bond market requires a dynamic approach, in our view. The asymmetric nature of bond market returns, which entails the potential for large downside risks with little upside potential, leads to our focus on risk management. We have reduced liquidity risk and increased credit quality by eliminating our positions in high yield bonds and bank loans while reducing our exposure to corporate bonds. We have increased our allocations to government bonds, mortgages and structured products, including asset backed securities.

The fixed income markets have historically been very fragmented, therefore we take a dynamic approach to investing in bonds. Our focus is on potential downside risk when thinking about our fixed income allocation. This approach is especially important due to the asymmetrical return profile of the asset class, which involves more downside potential and a somewhat limited upside. Several risk factors come into consideration when investing fixed income dollars. Interest rates, default rates, credit risk and liquidity are some of the key considerations when determining the risk budget for a fixed income allocation. Because these risks change over time, with the global economic environment, taking a dynamic approach is paramount to successfully investing in the fixed income space in our opinion. For example, there are times when we may want to take more or less credit risk, or change the fixed income sectors in which we are willing to take credit risk. Selecting which risk factors to have exposure to at any given time and how to balance risk exposures in certain situations can help potentially smooth the ride for investors.

Near the end of 2015, the Fed lifted short-term interest rates by 25 basis points, which was widely anticipated and, therefore, had previously been priced into the market in our view. The largest impact has been seen in the 6-month to 3-year area of the yield curve. While rates are up across the curve this year, the impact on the longer end has been less due mainly to a global flight to quality and the lack of inflationary pressures, which have kept demand for Treasury bonds strong. The hike itself is a deterrent to inflation, as is the deflationary pressure from the passive tightening that has already occurred with the end of the Fed’s quantitative easing.

Going forward, we do not think the Fed will get far with further rate hikes. The futures markets reflect a high probability that the Fed will raise interest rates to 75 to 125 basis points by the end of 2016. The Fed itself has suggested even higher short-term interest rates. Regardless, we think that any further rate hikes will continue to have the largest impact on the short end of the curve, as we expect continued strong demand for Treasuries and muted inflation. The indicators we follow point to continued high-quality bias through much of 2016.

Our current positioning in fixed income reflects our opinions regarding the high yield space, the path of interest rates and the economy. We exited our high yield position in the summer of 2014 as we became more cautious of liquidity premiums not being recognized by the market. At that time, we were concerned about potential increases in default rates and credit spread widening given the sector’s historically lax bond covenants.

We held exposure to bank loans until recently, as they are higher up in the capital structure, resulting in a lower risk of default. However, we sold these positions as our outlook became more cautious and we neared a potential rate hike that we thought could pose trouble for the space.

In our traditional bond allocation, we have increased credit quality by reducing exposure to corporate bonds in favor of government bonds and mortgage-backed securities. This has increased our overall duration to avoid the shorter end of the yield curve as the Fed raises interest rates. We continue to keep our alternative fixed income allocation diversified with credit exposures to structured product, such as asset backed securities (ABS), commercial mortgage backed securities (CMBS) and residential mortgage backed securities (RMBS). We find these sectors attractive on a valuation basis and the fundamentals remain sound at this time.

Gary Stringer is the CIO, Kim Escue is a Senior Portfolio Manager, and Chad Keller is the COO and CCO at Stringer Asset Management, a participant in the ETF Strategist Channel.