No one will confuse the recent reviews of the US economic trend as delivering clear signs of roaring higher these days, although there’s enough growth to keep the outlook for a rate hike alive for the Fed’s policy meeting next month. But everything comes with qualifications in the new world order, courtesy of the mixed messages that keep popping up in the numbers.

Take yesterday’s update on US industrial production for October. Output slumped for the second month in a row and the annual change decelerated to the slowest pace in nearly six years. But the manufacturing component, which dominates industrial activity, rebounded last month, posting the first rise in three months. Depending on your perspective, the October update on industrial activity offers a hint of a firmer macro trend–or another sign that slow growth is set to become even slower.

Pockets of weakness continue to harass the US economy in a variety of metrics, but there’s still no smoking gun that shows the macro trend overall is about to slip over to the dark side. The Atlanta Fed’s GDPNow model is currently forecasting (as of Nov. 13) that growth will pick up to a 2.3% rate in the fourth quarter (seasonally adjusted annual rate) from a sluggish 1.5% rise in Q3. That’s still a moderate pace at best, but it’s enough to keep the broad trend in the plus column.

Meanwhile, several business cycle indexes continue to tell us that recession risk is still low, based on the published data to date. For example, yesterday’s update of the Philly Fed’s ADS Business Conditions Index, which added Oct. industrial production, weighed on the benchmark, but only slightly. Running the index values through a probit model continues to estimate recession risk as a low-probability event—roughly 2%, in terms of the probability that the NBER will declare last month as the start of a new downturn.

So it goes as 2015 winds down. There’s trouble in spots, which is keeping overall economic growth weak to sluggish, but the forward momentum is still strong enough to keep the US out of the business-cycle ditch. Is there enough juice to convince the Federal Reserve to start raising interest rates at next month’s policy meeting? Not surprisingly, there’s a fair amount of debate but the hawkish clues are mounting. We’ve seen this before, only to watch the case for squeezing policy evaporate when the numbers turn surprisingly weak or some other factor rains on the party. Will it be different this time? Maybe. In any case, the tea leaves are again hinting that there’s a gently stronger case for a rate hike.

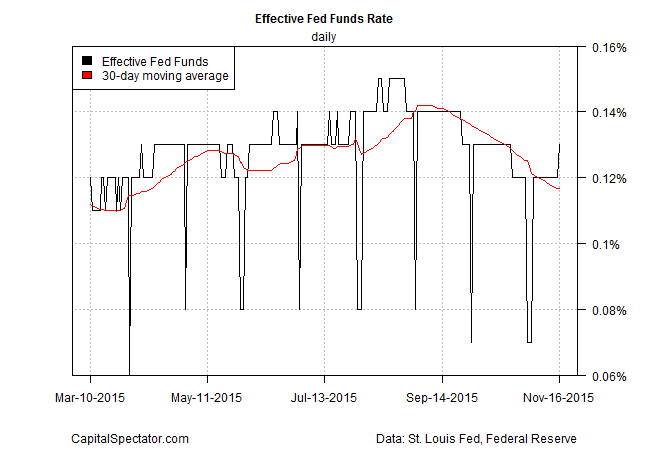

Consider, for instance, the latest uptick in the effective Fed funds rate. After two months of trending down, it appears that the tide may be turning. This is hardly decisive, but if the reversal continues the change will strengthen the view that the Fed is laying the groundwork for tightening, if only slightly.

Meanwhile, the rate-sensitive 2-year Treasury yield is holding on to most of its recent gains, which implies that the market’s still anticipating a rate hike next month.