On a different note, the other major commodity associated with war is gold, as it is known for its role as a safe haven in times of market crises. Using rolling 12-month returns (monthly year-over-year) from Jan 1979 – Sep 2015 of the S&P 500, the result shows that whether there was a bull, bear or flat stock market, gold was positive at least half the time. The stock market condition didn’t necessarily say anything about gold returns, but gold performed well when there were bear market conditions. It was positive the highest percentage of the time, 74%, in bear markets that lost more than 20%, and on average gold gained 6.5% historically in this condition.

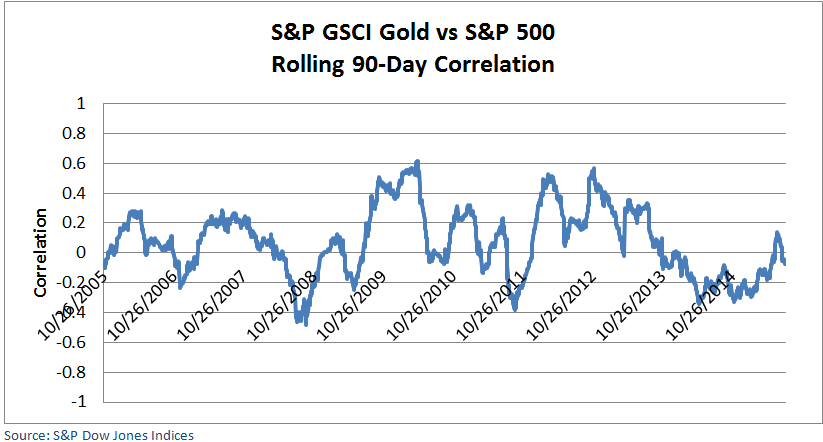

Since most single factors like inflation, interest rates, jewelry demand, oil prices, geopolitics and U.S. dollar strength don’t alone move gold, they are unreliable indicators of gold’s prices. However, one statistic that is pretty solid through time is that gold is uncorrelated to the stock market. On average, the 12- month correlation is zero but even on short intervals of rolling 90 days the correlation doesn’t ever exceed 0.6.

Based on this, the case can be made that gold has protected in down markets and has been a good diversifier.

In conclusion, despite the tragedy of the attack on Paris, commodities may help investors diversify through this difficult time. Oil prices have historically spiked in times of crisis, and with the production dilemma on the table for OPEC, Saudi may need to reallocate resources to national defense. There may be a demand reduction from the crisis but not enough to offset supply issues. This holds true for agriculture and livestock as well, that are more highly impacted by weather and may benefit from El Niño in the near future. Additionally, gold may also hold its role as a diversifier as it has in the past during stock market crises.

– See more at: http://www.indexologyblog.com/2015/11/17/terror-attack-on-paris-may-shift-the-oil-war/#sthash.GWJCwRhH.dpuf