Could India’s gold obsession be over? The Indian government seems to think so, since they are betting that their people are willing to part with their precious metal to earn just 2.5% interest. Last Thursday, Prime Minister Narendra Modi launched three programmes aimed at reducing physical gold demand and luring tonnes of gold from households into the banking system. That’s a big bet considering gold in India is a status symbol of wealth, and is widely used for wedding gifts, religious donations and as an investment.

However, it is possible Indian investors might follow the sentiment of investors in in other parts of the world that have already given up on gold. The record selloff in 2013 happened for a reason. Some place the main blame on the strong U.S. dollar, but the historical correlation of gold to the U.S. dollar is relatively weak measuring only about -0.3 to -0.4. So, it’s not only a strong dollar that is hurting gold but also the missing inflation and interest rates with the lack of demand for the physically backed ETF. It has caused the S&P GSCI Gold index to lose almost half its value, -43%, since Aug. 2011. Even after gold lost 28% in 2013, posting its biggest annual decline since 1981, it never bounced back but lost an additional 10%.

This loss has changed the perception of gold as a safe haven – and that is crucial. After all, the last two bull runs were driven by gold as a safe haven. When Nixon took the dollar off the gold standard in 1973, inflation tripled, the dollar crashed and years of erratic monetary policy followed, investors piled into gold as a safe haven. Again in 2001, fear rippled through the market, triggering the flight to safety into gold. The drivers of inflation and a weak dollar that supported gold through the 1970’s bull run were back. These factors plus the global financial crisis and worries about government reform led gold to a record high. Such forces in addition to the growing popularity of the gold ETF as a new way for investors to access gold sent gold soaring more than 600% over the next ten years, until its peak in Aug. 2011. If gold is not the safe haven it was thought to be, one might even question if another bull run is possible.

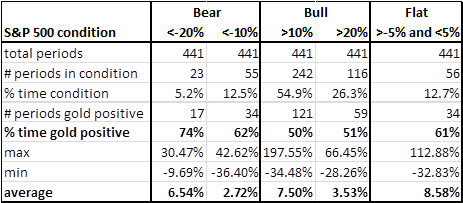

Since gold’s role as a safe haven is so seemingly important as a catalyst for a bull market, it is a legitimate concern as to whether gold has actually protected investors in past market crises. Since many investors use the S&P 500, let’s start with that as the market proxy. Using rolling 12-month returns (monthly year-over-year) from Jan 1979 – Sep 2015, the result shows that whether there was a bull, bear or flat stock market, gold was positive at least half the time. The stock market condition didn’t necessarily say anything about gold returns, but gold performed well when there were bear market conditions. It was positive the highest percentage of the time, 74%, in bear markets that lost more than 20%, an on average gold gained 6.5% historically in this condition. Based on this, the case can be made that gold has protected in down markets and has been a good diversifier.