Unfortunately for Indian investors, this does not hold true. The same analysis using the S&P BSE Sensex with the time period starting in Sep. 1996 shows gold performs far better in Indian stock bull markets than in Indian stock bear markets. Gold was only positive 43% of the time in the worst bear markets, and on average, lost 1.8%.

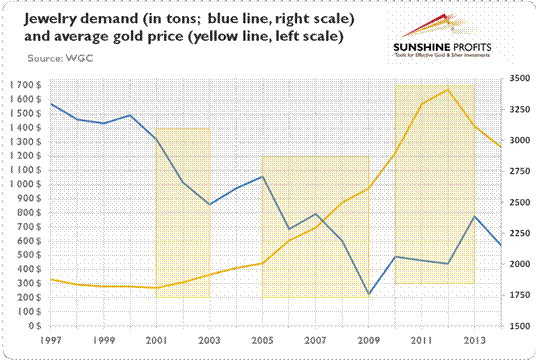

Is that enough to steer Indian gold buyers away from large purchases during Diwali? Probably not – and based on historical behavior, regardless of portfolio protection, diversification or future bull-run potential, the low prices have driven more gold buying. The below chart shows that when gold prices increased (decreased), jewelry demand decreased (increased):

Then if low gold prices increase gold buying for Diwali, will the buyers turn their gold over to the banking system? The lower value may make it more likely if gold loses its power to boost status and wealth in India.

– See more at: http://www.indexologyblog.com/2015/11/08/fallen-gold-may-help-indias-diwali-and-monetisation-plan-shine/#sthash.rnK2hLGW.dpuf