The duration of the laddered strategies rolls down and then increases when an index matures and the proceeds are reinvested in the next rung. This is in contrast to the Short-Term index whose duration is more stable through time.

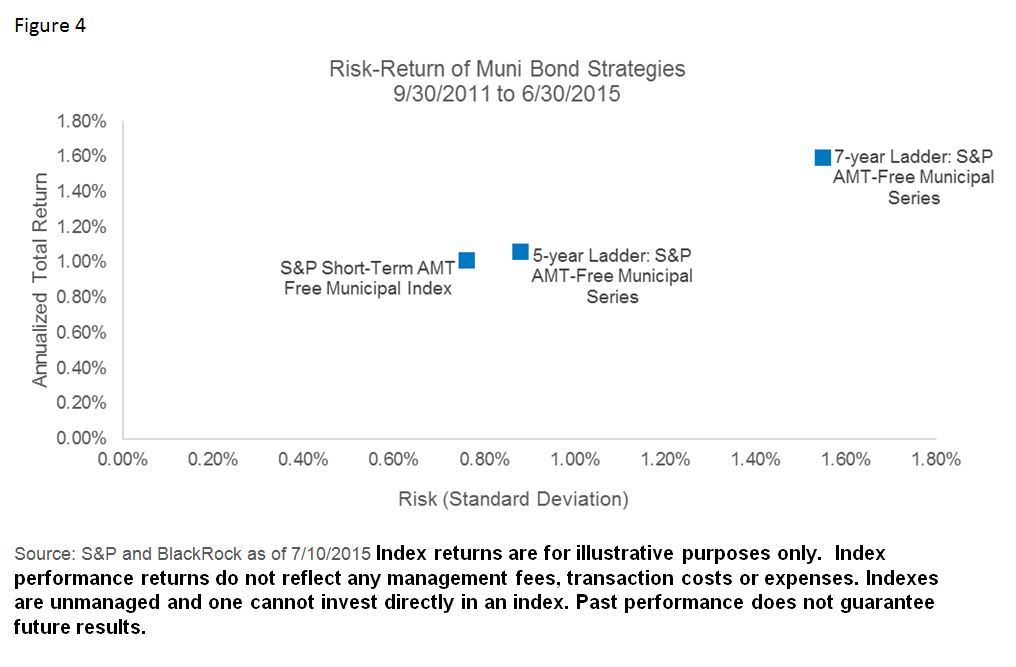

The performance of the 5-year ladder and the short-term index were similar. Note that the 5-year ladder had slightly higher return and volatility due to having an average duration that was slightly higher. Overall the duration differences between the three different portfolios was the largest driver of their performance differences.

Laddering a bond portfolio can provide investors with the flexibility to navigate the next round of rate hikes, while still helping meet their investment objectives. A laddering strategy can also provide more control over the portfolio, as an investor has an opportunity each year to reduce the size of the investor’s bond investment. A short-term municipal bond strategy has provided a similar risk and return experience to the ladder options, and might be appropriate if the investor does not want to manage the maintenance of a ladder, or does not need the option of withdrawing proceeds from the investment on a regular basis.

This article was written by BlackRock Managing Director and iShares Head of Fixed Income Strategy Matt Tucker.