While U.S. REITs have garnered a lot of attention in recent years and become quite a popular investment category, comparatively little attention has been paid to real estate securities based outside of the U.S., despite significant development in international markets. In February 1995, just three markets—Australia, the Netherlands, and the U.S.—were represented in the S&P Global REIT Index. By 2005, this had increased to 10 markets, and today, 23 markets are represented in the index, including several emerging market countries. As depicted in Exhibit 1, U.S. REITs have decreased from representing about 73% of the global REIT market in 1995 to representing 63% in 2015. This has occurred despite significant outperformance of U.S. REITs over the past several years (which has, of course, supported higher U.S. weightings).

The Importance of Including REOCs in Global Property Indices

In the U.S., virtually all public companies with businesses focused on real estate investment are structured as REITs. However, many countries around the world either do not have legislation authorizing REITs, or the REIT structure has not become as ubiquitous, which leaves many property companies outside of the scope of indices that only include REITs. As a result, more inclusive property indices, such as the S&P Global Property, are widely utilized in global markets because they include REOCs and other diversified real estate companies. These indices screen individual companies to ensure that the majority of their business activities involve the ownership and operation of real estate assets.

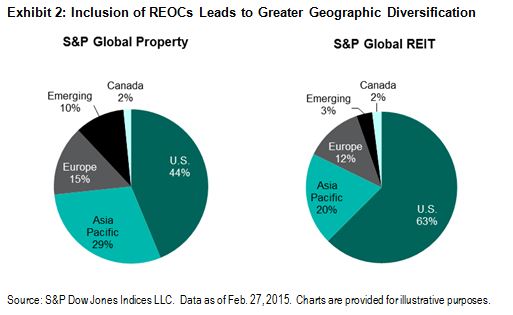

As Exhibit 2 illustrates, the inclusion of REOCs in the S&P Global Property leads to a significant decrease in concentration to the U.S. market (from 63% to 44%) and a substantial increase in exposure to international markets. Particularly noteworthy is the increase in weight to emerging markets (from 3% to 10%), where few countries have REIT-like structures in place.