There are no conclusive definitions of an asset class or definitive lists of asset classes, but asset allocation depends on how one chooses to define asset classes that collectively form the opportunity set. A company owned by Morningstar called Ibbotson Associates together with PIMCO pulled together some research on the topic that I think is interesting. They present a framework based on three super asset classes:

1. Capital assets, such as stocks, bonds and real estate, provide an ongoing source of value that can be measured using the present value of future cash flows technique.

2. Consumable or transformable assets, like commodities, only provide a single cash flow.

3. Store of value assets such as currency and fine art are not consumed and do not generate income but do have a monetary value.

The identification of the investable opportunity set significantly changes the potential risk and return possibilities. In another model, asset classes can also be thought of as risk factors or market exposures that produce a return that is not based on skill. These market exposures include sensitivities to financial markets, interest rates, credit spreads, volatility and other market-related forces.

Commodities offer an inherent or natural return that is not conditional on skill. Coupled with the fact that commodities are the basic ingredients that build society, commodities are a unique asset class and should be treated as such. Together, their sources of return have provided an important portfolio function.

The component of return called expectational variance that is caused by unexpected inflation – or supply shocks- is the main driver of the return differences between commodities and also between commodities and other asset classes. It is typical to observe this in the low correlations between commodity sectors as shown in the table below.

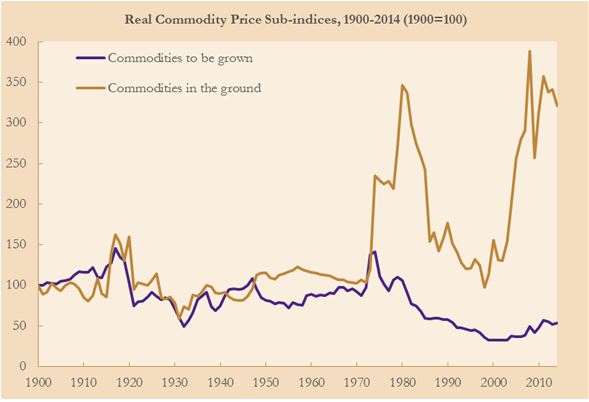

However, there is an important distinction between the commodities “to be grown” and commodities “in the ground”. The commodities in the ground are energy and metals and are finite, while the agriculture and livestock are commodities “to be grown” and are able to be replenished. As David Jacks points out, since 1950, there is a major historical performance difference of real prices for “commodities in the ground” that rose by roughly 180% versus real prices for “commodities to be grown” that fell by roughly 33%.

Source: http://apebc.ca/resources/Jacks_2015.pptx