If we’re talking about the worst performing months for commodities, March 2015 should be dominating the conversation. The S&P GSCI Total Return is down 9.1% month-to-date (as of 3/17/15) and is on track to post the 4th worst March in history of the index since 1970; only 2003 (-14.4%), 1980 (-14.0%) and 1974 (-11.5%) lost more. All 24 of the benchmark’s commodities are negative for the year with just four positive performers for the month: feeder cattle, natural gas, live cattle and Kansas wheat.

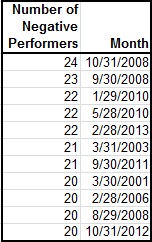

In the history of the index there have only been 11 of 545 months with as few positive performers as shown in the table below.

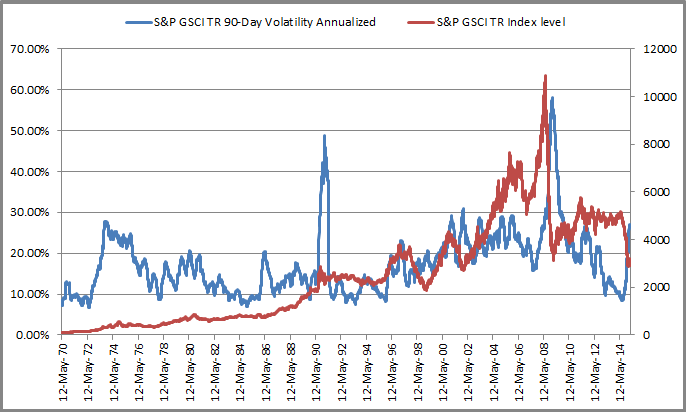

To add more to the madness, commodities have been the most volatile this March (annualized 90-day volatility of 27.1%) in almost six years – that is since December, 2009. This is after the index experienced annualized 90-day volatility of just 8.3% in August 2014, its lowest since December, 1995.

However, there might be a few bright spots in this March “Commodity” Madness. One statistic is that of the 24 commodities, 10 are currently in backwardation: live cattle, heating oil, feeder cattle, gasoil, unleaded gasoline, copper, wheat, silver, cocoa and Kansas wheat. Gasoil, unleaded gasoline, silver and Kansas wheat have flipped from contango with gasoil moving enough to produce a positive roll return for the year thus far.

Finally, we can’t ignore the Fed, especially today. They dropped the word “patient” and 15 of the bank’s top 17 officials think the Fed will raise rates sometime this year but with the economy seeming somewhat unsettled, at least temporarily, the Fed chairwoman effectively ruled out a rate increase in April and perhaps longer.

If the central bank starts to raise rates in June, analysts said that the U.S. dollar could be close to its peak and such an outcome would be supportive for dollar commodity prices. The good news for commodities is that when rates rise, it has been generally supportive of prices.

Source: S&P Dow Jones Indices LLC. All information presented prior to the index launch date is back-tested. Back-tested performance is not actual performance, but is hypothetical. The back-test calculations are based on the same methodology that was in effect when the index was officially launched. Past performance is not a guarantee of future results. Please see the Performance Disclosure at http://www.spindices.com/regulatory-affairs-disclaimers/ for more information regarding the inherent limitations associated with back-tested performance.

– See more at: http://www.indexologyblog.com/2015/03/18/commodity-madness/#sthash.ms53vvbn.dpuf