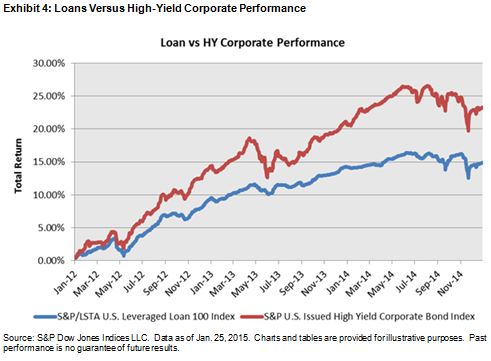

The S&P/LSTA Leveraged Loan 100 Index, which seeks to track the largest loan facilities, has been less volatile than the S&P U.S. Issued High Yield Corporate Bond Index over the past five years and it has achieved comparable risk-adjusted returns. Yields are also higher for the S&P U.S. Issued High Yield Corporate Bond Index than for the S&P/LSTA Leveraged Loan 100 Index (6.5% versus 5.05%, respectively), implying that market participants are willing to hold bank loans for less of an interest return than high-yield corporate debt.

With all credit, liquidity concerns for bank loans are real, but they should be viewed relative to the fixed income marketplace. The leverage loan bout might just be back-page news because it is lacking the glass jaw worthy of the K.O. headlines monopolizing page one.

This article was written by Tyler Cling, senior manager S&P Dow Jones Indices.

© S&P Dow Jones Indices LLC 2013. Indexology® is a trademark of S&P Dow Jones Indices LLC (SPDJI). S&P® is a trademark of Standard & Poor’s Financial Services LLC and Dow Jones® is a trademark of Dow Jones Trademark Holdings LLC, and those marks have been licensed to SPDJI. This material is reproduced with the prior written consent of SPDJI. For more information on SPDJI, visit http://www.spdji.com