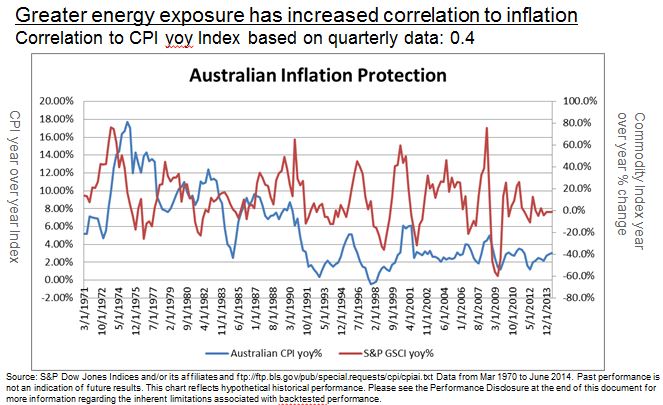

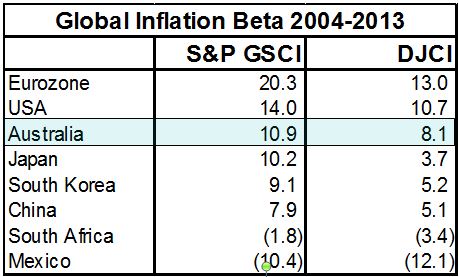

Notice the heavier oil in the S&P GSCI helped more than the more well diversified S&P GSCI Light Energy. Another question around oil is whether the global commodity basket hedges inflation in Australia given the market doesn’t produce much crude oil. This answer wasn’t so surprising since it it not quite as strong as the inflation protection for Europe or the US, but for a small investment, it is still possible to get a great inflation protection as shown by its inflation beta.

In conclusion, commodities as an asset class as represented by the global futures market has historically provided the diversification and inflation protection specifically to the Australian market. The great barrier to commodity investing in Australia shouldn’t be so great, especially with the offering of products that enable the locals to access this market.

This article was written by Jodie Gunzberg, global head of commodities, S&P Dow Jones Indices.

© S&P Dow Jones Indices LLC 2013. Indexology® is a trademark of S&P Dow Jones Indices LLC (SPDJI). S&P® is a trademark of Standard & Poor’s Financial Services LLC and Dow Jones® is a trademark of Dow Jones Trademark Holdings LLC, and those marks have been licensed to SPDJI. This material is reproduced with the prior written consent of SPDJI. For more information on SPDJI, visit http://www.spdji.com