Over the past two decades, real estate investment trusts (REITs) have emerged as a popular and efficient way for investors of all stripes to access the real estate asset class. Strong long-term total returns, combined with other key investment characteristics such as liquidity, high dividend yields, their potential to increase diversification and to hedge against inflation have contributed to the appeal of REITs.

Source: S&P Dow Jones Indices LLC; Barclays Capital. Data as of Sept. 30, 2014. Returns are based on total return index levels. REITs, Stocks, Bonds and Commodities are represented by the Dow Jones U.S. Select REIT Index, the S&P 500, Barclays Capital U.S. Aggregate Index and the S&P GSCI, respectively. Charts and tables are provided for illustrative purposes. Past performance is no guarantee of future results

REITs were established in the U.S. in the 1960’s and have evolved into a mature asset class here. However, outside of a handful of other early adopters such as Australia and Canada, the REIT structure had not been widely adopted globally until recently. In the past several years, REITs have gained traction globally as more and more countries around the world have enacted legislation authorizing REITs. In 2000, only 6 countries were eligible for SPDJ REIT indices. Today, twenty four are eligible with recent growth concentrated in Europe and Emerging Markets.

Source: S&P Dow Jones Indices LLC. Data as of Sept. 30, 2014. Charts and tables are provided for illustrative purposes.

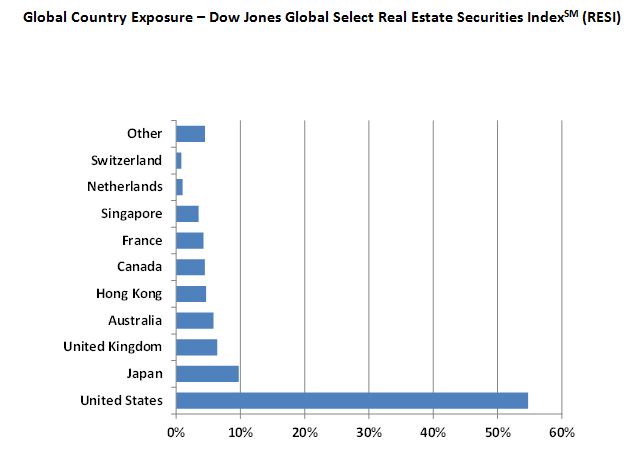

Although the U.S. remains by far the world’s largest REIT market by value, it now represents only about half of the global opportunity set for listed real estate securities.

To learn more about the REIT structure, their evolution as an asset class, and their investment characteristics see our paper REITs: Making Property Accessible.