Following in suit with the colors of the trees, investor sentiment appears to be cycling. While the market may not be trading high-yield junk for investment-grade positions as quickly as New Yorkers are trading in their flip-flops and shorts for scarves and umbrellas last week, market demand has shifted in October. The S&P/BGCantor U.S. Treasury Bond Index, which tracks over USD 7 trillion of outstanding treasury debt, responded to October’s equity volatility with investors moving toward quality. Wednesday, Oct. 15, 2014, risk adverse demand drove up the price of T-bonds; bringing yields down to the lowest end-of-day close in over a year, at 0.92% (see Exhibit 1). The shift in tide was not lost on the municipal bond market.

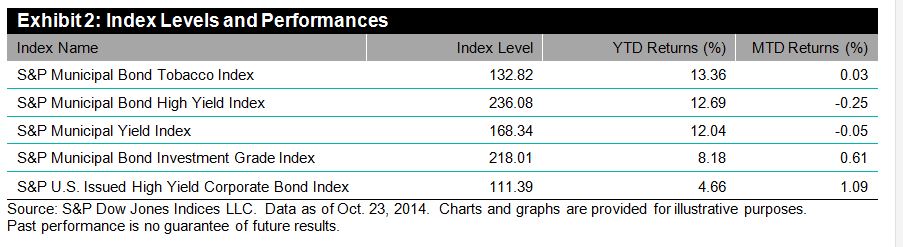

Thus far, 2014 has seen investors clamoring for yields in a low interest and low supply muni market. High-yield munis have outperformed their investment-grade counterparts. Bonds from the Tobacco Master Settlement Agreement of 1998, tracked by the S&P Municipal Bond Tobacco Index have performed outstandingly this year, up 13.36% YTD. However, up to this point of Q3 2014, high-yielding tobacco bonds have remained flat, at 0.03% (see Exhibit 2).

The S&P Municipal Bond High Yield Index, with a 12.69% return YTD, saw returns go the other way in October, down 0.25% for the month after a mild rebound. A similar trend occurred with the S&P Municipal Yield Index, down 12.04% YTD and down 0.05% MTD, although not as dramatically. The S&P Municipal Yield Index implements a weighted investment strategy based on blended quality (see Exhibit3). The S&P Municipal Bond Investment Grade Index only returned 8.18% YTD, yet saw a jump of 0.61% in October.