As volatility picks up, exchange traded funds that track a covered call strategy may help investors diversify a portfolio and augment their income generation.

On the recent webcast, Using Options to Maximize Returns, Nicolas Piquard, Vice President and Options Strategist with Horizons ETFs Management, points out that according to the Tobin Q’s ratio, a ratio that compares the market value of a company to the replacement value of its assets, the markets are looking pricey.

“The S&P 500 sits at about 1.1, which means the value of the U.S. stock market is slightly higher than the replacement cost of its assets,” Piquard said. “Historically, this has signaled the market is overvalued. If earnings confidence remains strong, the Q ratio will only continue to grow.”

Meanwhile, the CBOE Volatility Index, or VIX, is hovering around its low range, revealing a complacent market. In a recent survey, the majority of financial advisors expect market volatility to pick up.

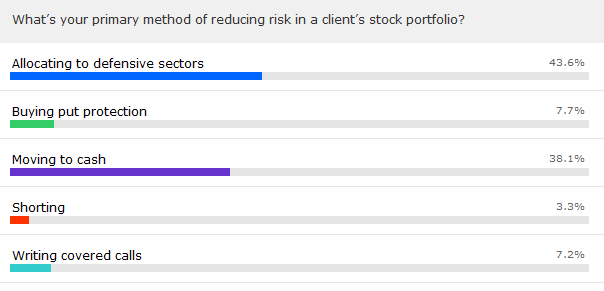

Most advisors only use traditional defensive strategies to hedge against volatility.

If volatility does pick up, investors can consider covered call ETFs like the Horizons S&P 500 Covered Call ETF (NYSEArca: HSPX), which uses covered calls with S&P 500 securities and Horizons Financial Select Sector Covered Call ETF (NYSEArca: HFIN), which tracks the S&P Financial Select Sector Covered Call Index.