Indexing is an investment approach which simply tracks an index to provide exposure to a market or segment of a market. For the three reasons listed below, it may be a viable complement or substitute to actively managed investments.

Firstly, indices outperform the majority of actively managed funds. The SPIVA Australia Scorecard, which is published twice a year, tracks the number of actively managed Australian mutual funds that were outperformed by their comparable benchmarks over different timeframes. The year end 2013 SPIVA Australia Scorecard showed that benchmark indices outperformed the majority of their comparable actively managed funds over three- and five-year horizons. Similar findings are also observed in the U.S., Canada and Europe SPIVA Scorecards.

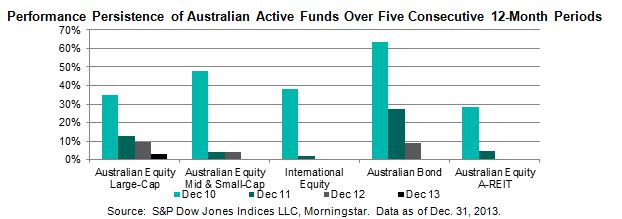

Secondly, winning streaks don’t often last. We observed that only very few Australian actively managed funds were consistent top performers. Out of 95 top-quartile-performing Australian Equity Large-Cap funds as of December 2009, only 3.2% managed to remain in the top quartile by the end of December 2013. In the US, less than 1% of domestic equity funds that began as top-quartile performers in March 2010 ended up in the top quartile almost four years later, as shown in the Persistence Scorecard published in June 2014.