Yields slightly increased, as the market’s growth slowed (but there was price appreciation)

Weighted dividend yield at the end of Q1,’14 was 2.48%, compared to 2.44% for Q4,’13, and Q1,’13 was 2.61%

Dividend yields remain relatively attractive compared to other instruments such as corporate bonds, treasuries, and bank CDs, especially considering the lower (permanent) tax rate advantage

Payout rates (dividends as a percentage of As Reported GAAP earnings) remain low, as companies payout record amounts, but payout less as a percentage of what they are making -> cash sets another record

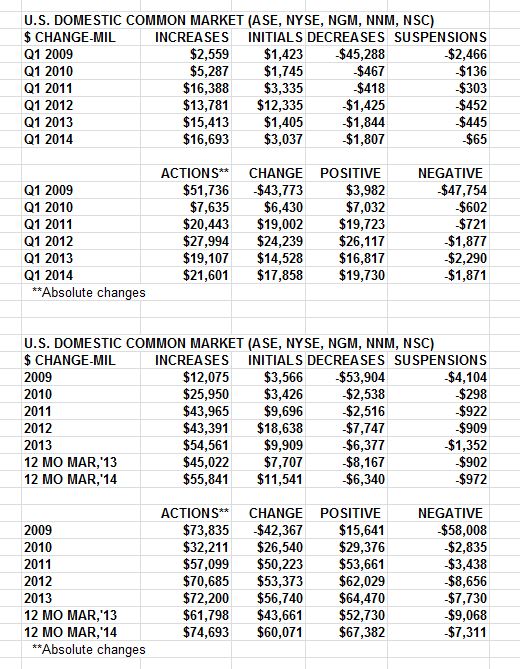

U.S. common stocks set a Q1 record (from 1955) for increases, beating out 1979 (fyi: 10-year is 2.68%, was 10.33% in ’79 and then went up to 15.8%; 500 yield is 1.9% and was 5.2%)

This article was written by S&P Dow Jones Indices Senior Index Analyst Howard Silverblatt.

© S&P Dow Jones Indices LLC 2013. Indexology® is a trademark of S&P Dow Jones Indices LLC (SPDJI). S&P® is a trademark of Standard & Poor’s Financial Services LLC and Dow Jones® is a trademark of Dow Jones Trademark Holdings LLC, and those marks have been licensed to SPDJI. This material is reproduced with the prior written consent of SPDJI. For more information on SPDJI, visit http://www.spdji.com.