I turn your attention to some fundamentals in the municipal bond market that may take your mind off the snow and cold that have dominated headlines this winter.

First, a thaw in the chilling performance of 2013 appears to have occurred so far this year for tax-exempt investors. Since the tapering comments the Fed made in May of 2013 and subsequent municipal fund redemptions, investors appear to have become comfortable with many analysts’ expectations that increases in interest rates are to be modest in 2014. Some investors seem to believe revisiting the municipal asset class may reveal opportunities. The trend of 2013 appears to have begun to change, as mutual funds and ETFs have started to experience a slight uptick of inflows in January as compared to December (see chart below).

Source: Morningstar as of January 31, 2014.

Second, on the back of these positive flows and muted new bond issuance, 2014 returns generally have been strong. The Barclays Municipal Bond Index was up year-to-date by 2.54% as of February 24, 2014.

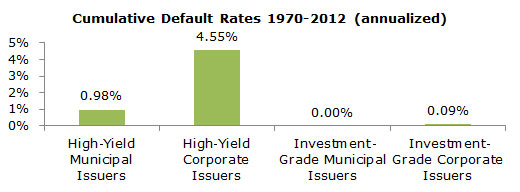

Confidence, I believe, can be described as a cumulative state of mind, and I think investors are being reminded of some of the positive elements of the municipal asset class, including low historical default rates (see chart below) and yields currently competitive with those of many other fixed-income investments, particularly on a taxable equivalent basis.

Source: Moody’s Investors Services, “U.S. Municipal Bond Defaults and Recoveries, 1970-2012.” Most recent annual study published May 2013. Historical information is not indicative of future results; current data may differ from data quoted. The Moody’s rating scale is as follows, from excellent (high grade) to poor (including default): Aaa to C, with intermediate ratings offered at each level between Aa and Ca. Anything lower than a Baa rating is considered a non-investment-grade or high-yield bond.

The Barclays Municipal Bond Index is considered representative of the broad market for investment-grade, tax-exempt bonds with a maturity of at least one year.