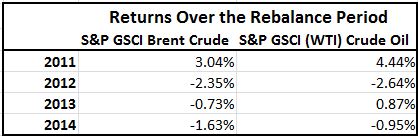

Maybe the verdict is still undecided for some, but it is hard to look at the evidence and still be questioning the idea that index investing drives underlying commodity prices. Now that the commodity index rebalance is over and the shift between WTI and Brent is behind, we can examine the impact. As I mentioned in a prior blog post, Not ALL Weights are EQUAL: Why Brent isn’t Heavier than WTI, there has been a dramatic move out of WTI and into Brent since 2011. Below is the table:

Source: S&P Dow Jones Indices.

If one follows the logic that prices increase based on index investing, then one would have witnessed falling WTI prices and rising Brent prices. However, that is not what happened.

Source: S&P Dow Jones Indices. Data from Jan 2011 to Jan 2014. Past performance is not an indication of future results. This chart reflects hypothetical historical performance. Please see the Performance Disclosure at the end of this document for more information regarding the inherent limitations associated with backtested performance.

Notice 3 out of 4 years when the index weights were increasing in Brent, the return over the rebalance period was negative. Also notice that in 2 of 4 years when the index weights were decreasing in WTI, the return over the rebalance period was positive.

Supply and demand should be unaffected by commodity futures investing since there is no physical delivery from commodity futures investing. Along with the simple example over the rebalance, there are fundamental stories that demonstrate a disconnect between money flow and price. For example, Brent recently fell pressured by incremental increases in Libyan oil supply and expectations that Iranian crude will return to market.

Another simple argument is as follows: trading, production and open interest stats are similar for crude oil and natural gas where futures trading volume is several times larger than production or consumption. Sometimes oil prices are up while natural gas is down, so how can futures trading be driving price of oil up while gas, with same trading stats, is down? (Nat gas may be down from fracking technology increasing supply. A supporting comment is at http://www.econbrowser.com/archives/2012/04/a_ban_on_oil_sp.html with a follow up at http://www.econbrowser.com/)