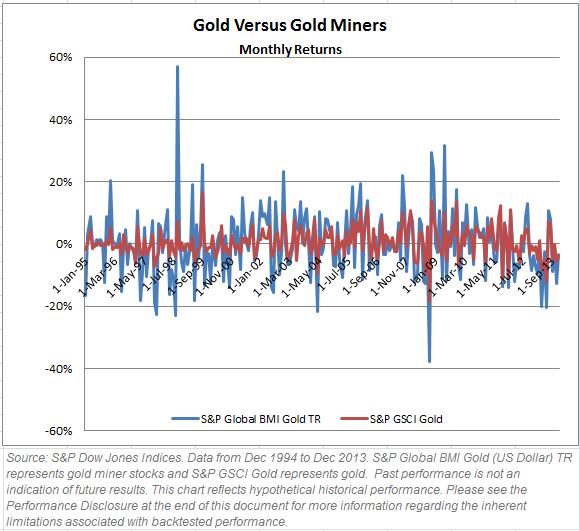

Why is this? The losses of the gold miners are so much bigger in the negative years for gold and not as positive in the positive years for gold. On average when gold lost in a year, it lost 12.1%, while gold miner stocks lost 27.7%. When gold gained in a year, on average it returned 14.4% but gold miner stocks were only up 12.8%.

Also, the annualized volatility of the gold miner stocks is 37.1%, double that of gold at 16.7%.

Although there have been years with positive gold returns and negative gold miner stock returns, there has never been a negative year for gold with a positive gold miner stock return. So, a falling gold price could be a bad sign for the gold miners.

About Jodie Gunzberg

Jodie M. Gunzberg is vice president at S&P Dow Jones Indices. Jodie is responsible for the product management of S&P DJI Commodity Indices, which include the S&P GSCI® and DJ-UBS Commodities Index, the most widely recognized commodity benchmarks in the world. Both indices represent the global commodity market and are most commonly used for the historical benefits of inflation protection and diversification to stocks and bonds.

© S&P Dow Jones Indices LLC 2013. Indexology® is a trademark of S&P Dow Jones Indices LLC (SPDJI). S&P® is a trademark of Standard & Poor’s Financial Services LLC and Dow Jones® is a trademark of Dow Jones Trademark Holdings LLC, and those marks have been licensed to SPDJI. This material is reproduced with the prior written consent of SPDJI. For more information on SPDJI, visit http://www.spdji.com.