Unfortunately for the S&P GSCI, which is world production weighted and adjusted by volume, natural gas doesn’t have a great impact since its target weight was only 2.5% in 2013 and 2.6% for 2014. That can work both ways though, the flip side was that the index only had a 2.8% weight in gold. Fortunately for the DJ-UBS, the natural gas weight was 10.4% in 2013 BUT gold was 10.8%. Every sector besides energy was a loser, and the index weighting difference made all the difference in the annual performance with the S&P GSCI losing 1.2% and the DJ-UBS down 9.5%. The difference in the methodology for weighting is described in Not ALL Weights Are EQUAL: Why Brent isn’t Heavier than WTI. See the charts below for the 2014 energy weightings:

Source: S&P Dow Jones Indices and/or its affiliates. Target Weight 2014 data published in 2013 press releases. Charts are provided for illustrative purposes. Past Performance is no guarantee of future results. These charts and graphs may reflect hypothetical historical performance. Please see the Performance Disclosure at the end of this document for more information regarding the inherent limitations associated with back-tested performance.

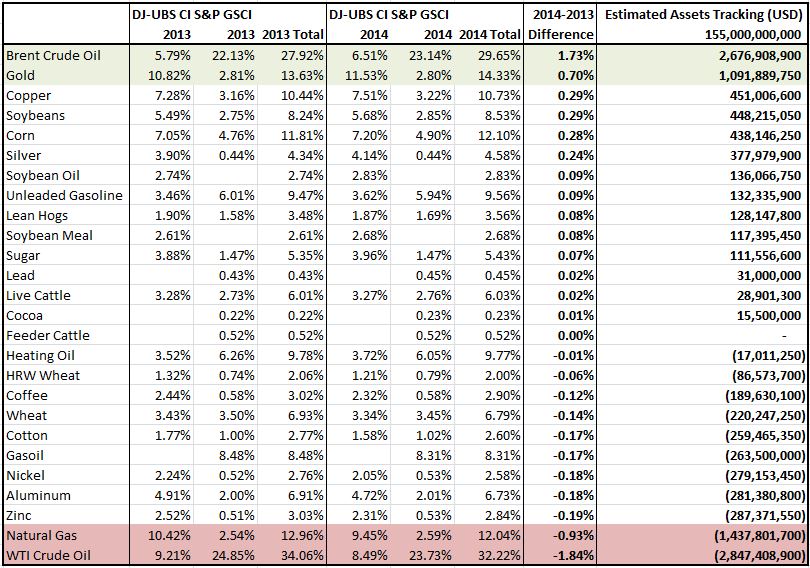

One of the big questions besides which commodity will be the winner or loser in 2014, is: How does the rebalance impact the market? From the press releases earlier this year about assets tracking, the DJ-UBS rebalance and the S&P GSCI rebalance, approximately $12.4 billion is set to move over the 2014 rebalancing period starting today.

Source: S&P Dow Jones Indices. Estimated Assets Tracking each index are as of Dec 2012.

About Jodie Gunzberg

Jodie M. Gunzberg is vice president at S&P Dow Jones Indices. Jodie is responsible for the product management of S&P DJI Commodity Indices, which include the S&P GSCI® and DJ-UBS Commodities Index, the most widely recognized commodity benchmarks in the world. Both indices represent the global commodity market and are most commonly used for the historical benefits of inflation protection and diversification to stocks and bonds.

© S&P Dow Jones Indices LLC 2013. Indexology® is a trademark of S&P Dow Jones Indices LLC (SPDJI). S&P® is a trademark of Standard & Poor’s Financial Services LLC and Dow Jones® is a trademark of Dow Jones Trademark Holdings LLC, and those marks have been licensed to SPDJI. This material is reproduced with the prior written consent of SPDJI. For more information on SPDJI, visit http://www.spdji.com.