Chart Courtesy: Bespoke Investment Group

A case can be made that the consumer discretionary sector, although on the rise as the Bespoke data indicate, is under-represented even at a weight of 12.5%. The sector has gained 420 basis points, or about 50%, in prominence in the S&P 500 since March 2009, but the Consumer Discretionary Select Sector SPDR (NYSEArca: XLY) is far and away the best sector SPDR over that time with a gain of 333%. [Sector ETF Investing: A Long Term Perspective]

Interestingly, health care’s weight of 13.3% today is 280 basis points below where it was on March 9, 2009, but 120 basis points higher than at the end of last year. Interesting because the Health Care Select Sector SPDR (NYSEArca: XLV) is the top SPDR this year with a gain of 40%.

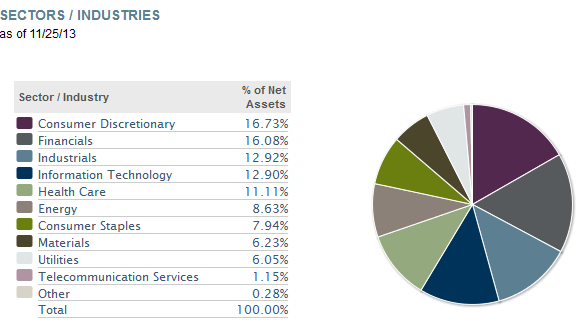

The Guggenheim S&P Equal Weight ETF (NYSEArca: RSP) is another interesting case. RSP has a reputation for outperforming the S&P 500, something it has done again this year. RSP’s overweight (16.7%) to discretionary has helped.

However, RSP is also underweight health care by 220 basis points and underweight tech by 470 basis points.

RSP Sector Weights