“Institutions across the board have found ETFs to be helpful as a liquidity overlay strategy, whereby they use ETFs that mirror their portfolio allocations with the added benefit of being able to source ETF liquidity for spending needs. The greater value placed in ETFs; transparency likely reflects the broader trend of increasing regulatory demands on institutions for more detailed disclosure,” said Gamba.

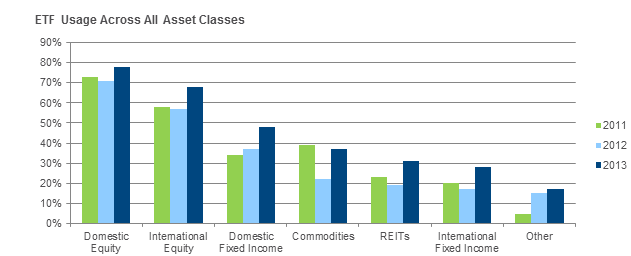

Institutional use of ETFs is also growing across asset classes. Although U.S. and foreign equity-based ETFs remain the primary ETF stomping grounds for institutional investors, usage of global bond, commodities and REIT ETFs, among others, is on the rise.

ETF usage is widespread across asset classes. Over the past year, there has been growth in all categories. Domestic and international equity ETFs continued to be the most commonly utilized and domestic fixed income ETFs ranked third. Year-over-year survey results show increased use of fixed income ETFs. Between 2012 and 2013 domestic ETF usage increased from 37% to 48% and international fixed income ETFs grew from 17% to 28% of respondents, according to BlackRock.

Chart Courtesy: BlackRock

ETF Trends editorial team contributed to this post.