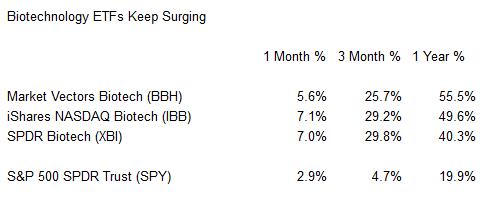

In a similar vein (pun definitely intended), there are plenty of reasons to eschew biotechnology ETFs. Price-to-fair value estimates are unfavorable. Legislative uncertainty presents hazards for pharmaceutical research and development. And the current price on many biotech stocks, as well as biotech funds like Market Vectors Biotech (BBH), are more than 20% above a 200-day moving average; a tendency for stocks to revert to their trendlines would certainly be painful.

Whereas the Internet ETFs benefit from a younger demographic (25-54), biotech ETFs benefit from increasing longevity. Not only is most of the wealth in the U.S. controlled by folks who are 55+, but investors perceive those individuals as having the capacity and desire to spend money to prolong/enhance their lives. Here again, a demographic-based perception is fueling investor demand beyond levels that normal valuations might justify.

For my own clients, I have been far more conservative over the last year. I have maintained an overweight towards technology and health care, though I have primarily done so with exchanged-traded funds like Vanguard Information Technology (VGT), First Trust Technology Dividend (TDIV), SPDR Health Care (XLV) and PowerShares Pharmaceuticals (PJP). Moreover, it would be awfully difficult for me to recommend the sexier funds in the tables above without a substantive price pullback as well as a rationale beyond the demographic-based theme.

Granted, momentum investors may like biotech and “new tech” right now. As long as those who choose to ride a wave today know exactly when to hop off a surfboard, I see nothing wrong with the initial buy decision. Just make certain to implement a plan for leaving, whether your plan involves hedges, options or trailing stop limit orders.

Gary Gordon is president of Pacific Park Financial, Inc.