Very few investments can thrive in August’s environment of U.S. central bank policy uncertainty. You might even say that we are seeing signs of a mini-panic — a quasi-stampede for the exits of virtually anything with a yield component. Yet the reversal of fortune on Apple (APPL) is certain to buoy technology ETFs.

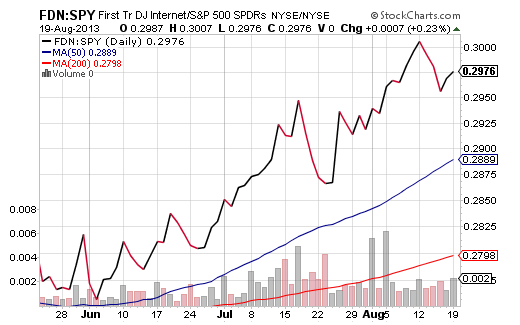

Similarly, First Trust Internet (FDN) may be one of the few funds that is demonstrating three solid months of increasing relative strength against the broader market. Not only is the current price above a 50-day and 200-day trendline, but FDN’s relative strength versus SPY is near a high for 2013.

In reality, even tech and health care ETFs will not be able to handle an unchecked rise in longer-term yields. The surprisingly swift run from 1.6% to 2.9% on the 10-year has already decimated investor perception of homebuilding and real estate-related assets; fears of a significant slowdown in consumer spending is another thorn in the bull’s side.

The best moves today? Sell those assets that have been the biggest drag on your portfolio to free up some cash. Use the cash to buy coveted ETFs as the market corrects. That means, continue to favor areas of the market that possess a combination of defensive qualities and limited rate sensitivity.

Gary Gordon is president of Pacific Park Financial, Inc.