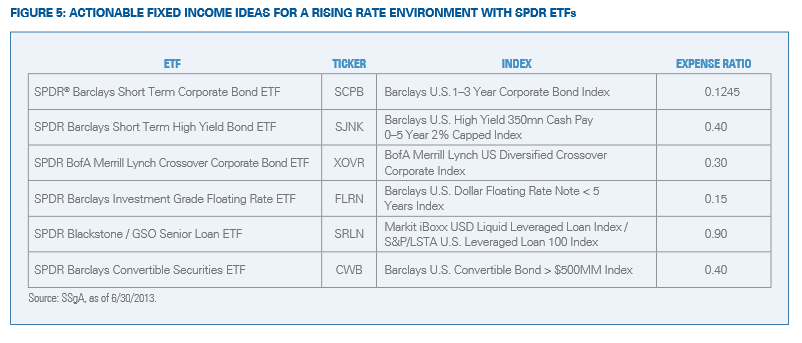

Short-term corporate bonds

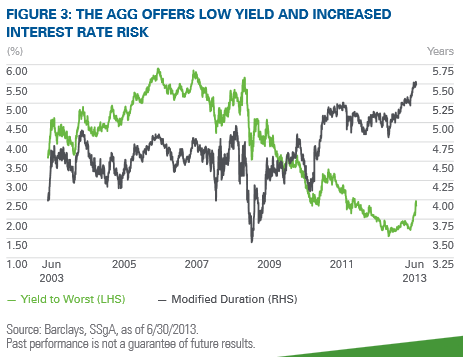

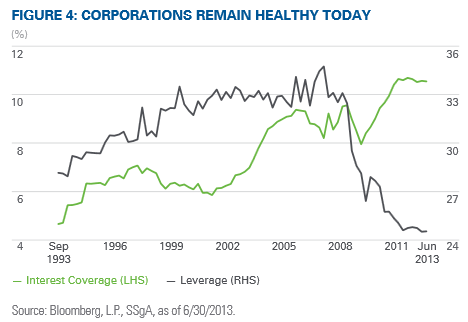

In today’s market, a main concern for investors is interest rate risk. Shorter durations allow for greater protection in an environment of rising rates and for reinvestment at potentially higher yields. However, many investors may not be fully harnessing the credit exposure that they wish to target. More specifically, investors may wish to avoid exposure to the government-related sector as opposed to simply owning securities in the industrial, utility and financial sectors. What further compounds the matter is that government-related sectors are either highly leveraged or low yielding.

Short-term high yield bonds

Market participants have embraced the benefits of high yield bonds in a low rate environment and one conducive to credit exposure. With absolute yields compressed and option-adjusted spreads around historical averages, some are questioning how much more return the segment can provide. It may be the case that investors are correct to recalibrate their return assumptions, but the market is not yet exhibiting signs of excess froth from a credit perspective. While certain segments may be richly valued and subject to greater volatility, there are options for investors who wish to remain exposed to below investment grade credits, but with less potential for performance fluctuations. One such area is short-duration high yield. While high yield is a market segment with generally low duration, short-term higher yield offers attractive yield per unit of duration. The 0–5 year maturity window offers half of the interest rate risk of longer maturity bonds with the added benefit of less performance volatility.

Crossover bonds

By focusing on the lowest rated investment grade and the highest rated below investment grade crossover bonds, investors are able to harness inefficiencies in the corporate market. By doing so, investors can avoid the lower spreads available in higher rated AAA and AA-rated bonds while at the same time avoiding the most speculative, equity-like exposure of CCC-rated high yield bonds. In addition, what investors may not know is that BBB and BB-rated bonds have offered the highest sharpe ratios of any rating bucket over long-term periods.This market segment provides a relatively attractive yield with moderate duration, an excellent combination to combat today’s challenges.

Senior secured loans

With yields that are comparable to unsecured fixed rate high yield bonds, senior secured loans are an increasingly compelling option to further evolve portfolios in today’s environment. Senior loans are floating rate instruments while most high yield bonds are fixed rate. This means that loans have the ability to see their rate of income increase should rates normalize, which fixed rate bonds cannot do. More specifically, because loans reset they have minimal duration risk. Investors are increasingly recognizing that it pays to wait with loans. In addition, because loans are senior in the capital structure to bonds, they have experienced significantly greater recoveries in cases of defaults than have unsecured bonds.

Convertible securities

As hybrid securities, convertible securities combine the upside potential of stocks while exhibiting some of the downside protection inherent in bonds. Convertibles tend to have low sensitivity to interest rate risks, which make them more resilient to rising rate environments. In fact, while convertibles do pay interest they can be converted into their shares of the issuing company and have exposure to underlying equity fundamentals, which often perform well when rates are increasing.

Conclusion

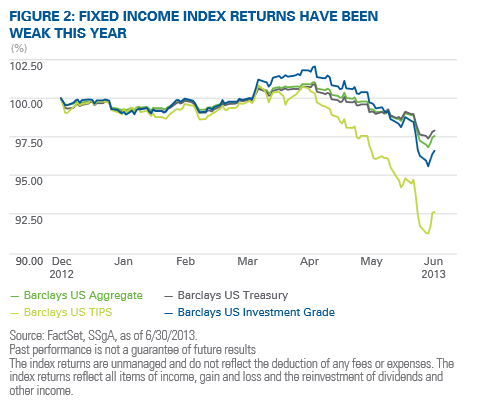

With 10-year TIPS moving into positive territory, investors appear to be pricing in Fed tightening or at least tapering sooner than many expected. In fact, yields could move up more if economic growth surprises to the upside or the market continues pricing in Fed policy changes earlier than expected. Many are looking back to previous Fed tightening signals for clues and courses of action. With 1994 and 2004 potentially providing weak guidance due to the extent of extraordinary monetary policy today, investors should look beyond the core to build portfolios that behave less like return-free risk. In doing so, investors can also move beyond certain well-trodden segments that may be crowded and no longer offer their historical value propositions. Unique credit exposures through various corporate bond segments are an especially attractive solution today and allow for the development of more resilient and adaptive fixed income portfolios in a rising rate environment.

David Mazza is vice president and head of ETF investment strategy, Americas, for State Street Global Advisors, which manages the SPDR ETFs.