What Is Behind the Physical Gold Shortage?

There are a number of factors behind the physical gold market shortage. First, the surge of China demand since early 2013. China imports of gold from Hong Kong in the first six months of 2013 amounted to 16moz, more than double the amount imported by China over the same period last year (Figure 3). Strong demand from China is also reflected in the premium of the Shanghai gold price over the London price (Figure 4). The premium reached a 21-month high in May. Despite the recent sell-off in the gold ETP market, physical buyers, particularly from Asia, appear to be taking up the slack. In the first half of 2013, UK exports of gold to Switzerland soared to almost 26moz, equivalent to 30% of global mine production, with much of the supply likely coming from ETF liquidations. Hong Kong imports of gold from Switzerland surged to 12moz over the same period, evidencing a shift in gold demand from the West to the East (Figure 5). The sharp fall in gold recycling is also likely weighing on overall physical availability, exacerbating the current shortage. Historically, there is a positive correlation between the gold price and scrap supply, as there is an incentive for gold holders to sell their gold when prices are elevated (Figure 6). Last year, 36% of gold supply came from old scrap as prices averaged US$1,669oz vs only 30% in Q2 2013 when prices averaged US$1,415oz.

Implications for the Gold Market

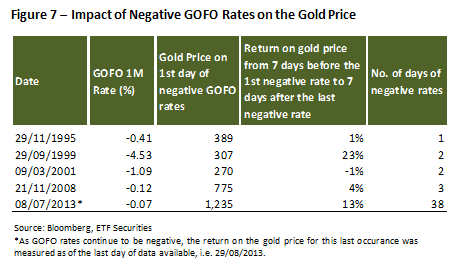

Historically, when GOFO rates have turned negative the gold price has also risen (Figure 7). With the exception of 2001, the gold price has tended to rally after the one-month GOFO rate has turned negative. Since July 2013, the gold price has increased by over 13% as a surge in physical buying following the April slump in price have drained liquidity out of the gold forward market. Imports of gold from China were 150% higher in June compared to the same period last year, continuing the trend of the previous months (Figure 3). Central bank buying also increased in the six months to June 2013, reaching 5.7moz, an 8% year-on-year gain. With demand from Asia and the official sector continuing to show strength, and recycling trending down, lack of liquidity in the gold forward market is likely to continue to support the gold price. In the longer term, with mine supply also likely to fall as gold miners struggle with rising costs and lower profitability, supply-side factors are likely to continue to support the gold price.