I might be more inclined to short Japanese government bonds. However, I’m not willing to go against the Bank of Japan just yet. The shock-n-awe campaign of the largest pound-for-pound QE program in the world means that I will be watching the trends of notes like PowerShares DB 3x Inverse Japanese Government Bond Futures (JGBD) as well as the more subdued PowerShares Inverse DB Inverse Japanese Government Bond Futures (JGBS).

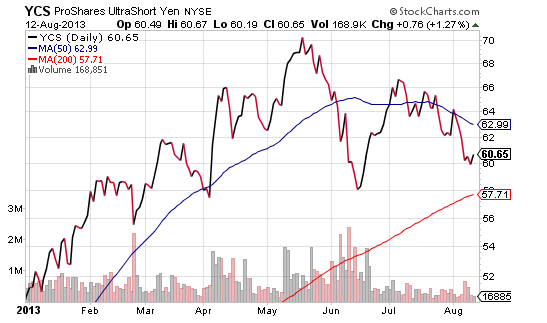

The fund with the best shot of success at this juncture may be ProShares UltraShort Yen (YCS). Recent yen strength has left the yen struggling for long-term direction, yet YCS is still above a long-term 200-day moving average. With support at the 57 level, as well as an unwavering determination by the Bank of Japan to weaken its currency and to strengthen its hand in foreign trade, YCS lines up nicely with the quadrillion yen quandry.

Gary Gordon is president of Pacific Park Financial, Inc.