On the other hand, if Japanese money printing and subsequent debt acquisition is such a boon to Southeast Asian economies, one has to wonder why the International Monetary Fund (IMF) has lowered its global growth forecasts for 2013 and 2014. Similarly, the majority of non-Japanese stock ETFs in the region have abysmal 6-month returns.

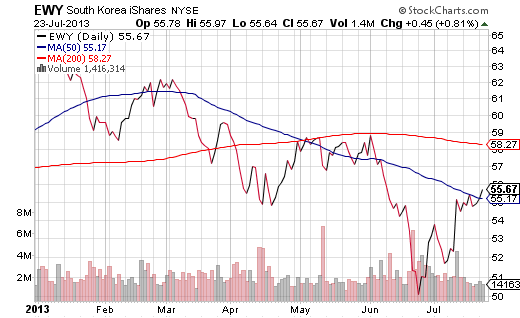

Shinzo Abe’s political success notwithstanding, there are reasons for newfangled optimism for non-Japanese Asian ETFs. Specifically, China’s leaders appear to be looking for an avenue to stimulate the Chinese economy. Beijing News reported that Premier Li Keqiang will make sure to keep economic growth above 7%. Unlike the volatility associated with yen-devaluing quantitative easing in Japan, fiscal and monetary programs by Chinese leadership are likely to increase demand for foreign-made products and services. Hong Kong (EWH), Taiwan (EWT) and Korea (EWY) could benefit.

Gary Gordon is president of Pacific Park Financial, Inc.