What if valuation is not the key to success with your emerging market pick? For example, Poland has cut rates at a remarkably fast clip, sending its overnight bank lending rates to a record low (2.5%). In an investing world where the most monetary stimulus means the best investment, Poland has been a brighter spot than the neighboring euro-zone. One can look at either iShares MSCI Poland (EPOL) or Market Vectors Poland (PLND).

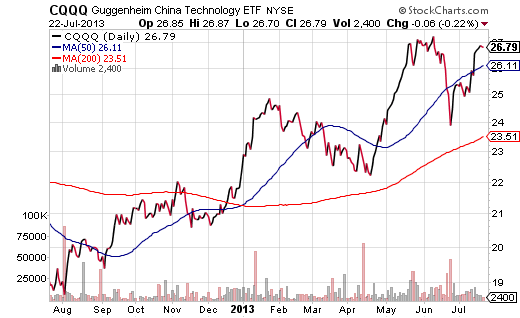

Finally, technology firms from the world’s 2nd largest economy are both inexpensive on a fundamental value basis as well as capable of winning the momentum game. Consider Guggenheim China Technology (CQQQ) as a way to capture information tech stand-outs like NetEase, Sina and Sohu.

Gary Gordon is president of Pacific Park Financial, Inc.