However, none of these explanations solely explain gold’s recent price declines, which largely seem to be driven by a confluence of them all. These explanations also don’t foretell much about future performance. While the price of gold has stabilized and rebounded since its mid-April lows, skeptical investors should ask themselves the following questions: Do I think China and other emerging markets will no longer be the source of global growth in the future? Do I think developed market countries will stop taking extraordinary measures to combat the impacts of deleveraging? Do I think that the US dollar will exhibit a prolonged period of strength? If the answer is no, than investors who opted to or are considering selling should keep in mind that many of the fundamental reasons why gold was attractive in the past continue to remain intact today.

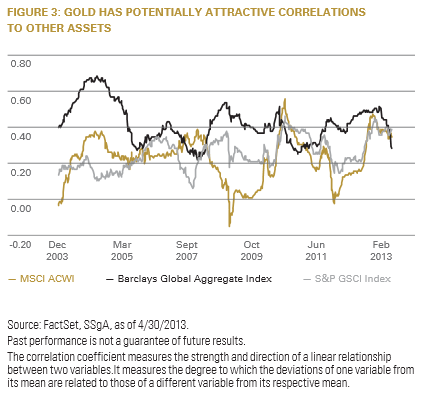

Furthermore, it’s worth considering gold’s role in portfolios, which is independent of price. Gold’s low correlation to other asset classes suggests that it has the potential to improve the efficiency of portfolios. While static correlation statistics are useful, it can be more instructive to look at rolling correlations. Under this framework, one can see how gold’s relationship to other assets may change over time. What’s interesting today is that gold’s correlation to global fixed income has been steadily dropping since the start of this year and is now below historical averages. This suggests that gold may have increased diversification benefits.

In the immediate-term, certain investors may point to gold dipping below important support levels and lacking key drivers of near-term demand. Acknowledging important evolutions that have changed the dynamics of the gold market is important to dispelling concerns brought on by these immediate- term markers. These include the creation of gold-backed ETFs that have brought liquidity, transparency and cost efficiency to the market, not just in the US, but around the world, and the liberalization of the Chinese gold market with the establishment of the Shanghai Gold Exchange. The later evolution plays an important role in outlining how geographical demand for gold in a supply-constrained market has shifted from the western world to the eastern world. At the same time, today’s demand is more balanced, with jewelry, technology, investment and perhaps most importantly, central bank purchasing, all playing a role.

In conclusion, gold may see near-term volatility as the market reassesses the level at which gold should be priced, today. Drawdowns of this nature have occurred before, and with little change to the underlying supply and demand characteristics that underpin gold’s price, gold may see better days ahead. Based on historical performance, which isn’t necessarily predictive of future results, this period may serve as a buying opportunity similar to those in past cycles. In the meantime, investors may be well served by using a pullback in an individual asset, such as gold, to review their entire portfolio and look to construct one with a combination of the best expected future risk-adjusted returns.