The latest weekly ETF flow data reveals investors are rotating way from defensive ETFs that led the way through most of 2013 but are now taking a back seat to cyclical sectors.

For example, Health Care Select Sector SPDR (NYSEArca: XLV) and Consumer Staples Select Sector SPDR (NYSEArca: XLP) saw the heaviest outflows last week, according to IndexUniverse data.

Utilities Select Sector SPDR (NYSEArca: XLU) was also on the list of ETFs with the biggest redemptions last week.

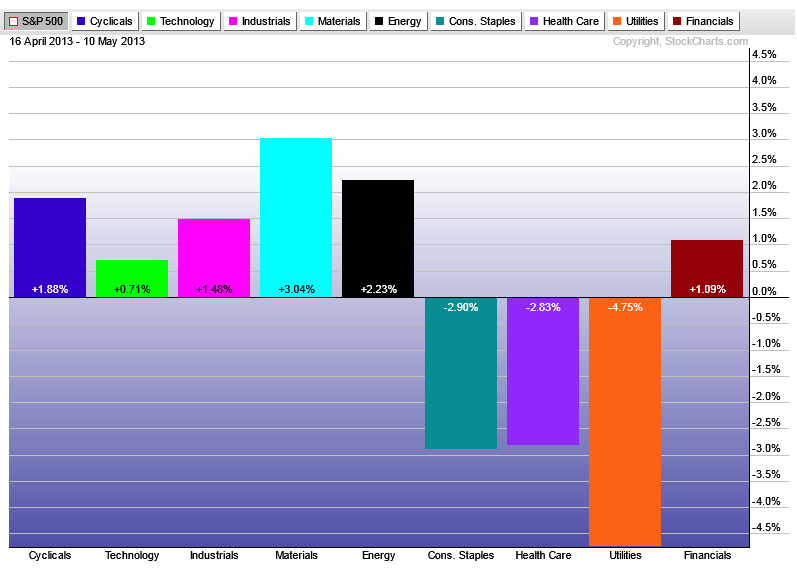

Stable, dividend-paying sectors such as utilities, consumer staples and healthcare had paced the market since mid-April. Yet the recent outperformance of growth-oriented sectors is seen as a healthy rotation that could help push stocks even higher. [Some Sector ETF Charts Pointing to a Cyclical Rotation]

During the most recent leg of this rally, the utilities, consumer staples and healthcare sectors have all underperformed the S&P 500, says J.C. Parets at the All Star Charts blog.

“Meanwhile, it’s been materials and energy that have led the way,” he notes.

Furthermore, PowerShares S&P 500 Low Volatility (NYSEArca: SPLV) and iShares MSCI USA Minimum Volatility (NYSEArc a: USMV) were among the ETF outflow leaders last week. This is another sign that investors are shifting away from defensive ETFs. [Are High-Beta Funds the Next Low-Volatility ETFs?]

Source: IndexUniverse, ETF flow data May 6-May 10.

The opinions and forecasts expressed herein are solely those of John Spence, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.