When most people think of exchange traded products (ETPs), the first thing that comes to mind is often an ETP based on a market capitalization weighted index – the S&P 500, for example.

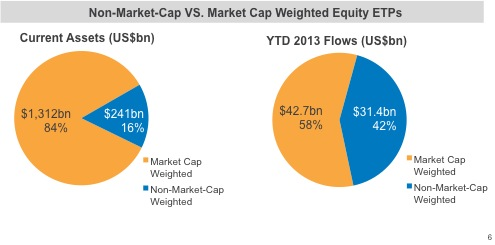

And with good reason – most of the first ETPs tracked these more traditionally weighted indexes, and today market cap weighted ETPs account for about 84% of equity ETP assets globally.

But while market cap has historically been the most popular weighting scheme for indexes, over the years the ETP industry has brought more and more products to market that are based on non-market cap weighted indexes.

Examples of this include indexes that are price weighted, fundamentally weighted (e.g. dividend weighted) and low volatility strategies.

And it appears that investors are taking notice of this diverse and dynamic category: Year-to-date, non-market cap weighted equity ETPs have captured 42% of equity ETP flows, compared with the 20% of flows they brought in last year (see below).